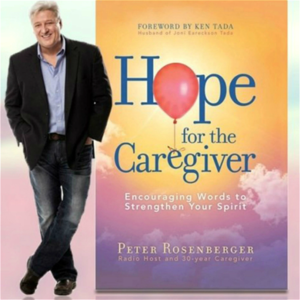

This is Peter Rosenberger and I'm really excited to tell you about my new book. It's called A Minute for Caregivers When Every Day Feels Like Monday.

I compiled a lifetime of experience to offer a lifeline to my fellow caregivers. Each chapter only takes one minute to read them. I know I timed them. You can read them in order. You can read them out of order. You can flip to any page and you're going to find something on that page that will help you at that moment.

It's called A Minute for Caregivers When Every Day Feels Like Monday. Go to Hopeforthecaregiver.com slash book. Hopeforthecaregiver.com slash book. And you can sign up. We'll let you know as soon as it's available for pre-order.

We'll send you a special bonus feature for it, sample chapter, all kinds of things. Go to Hopeforthecaregiver.com slash book. I can't wait for you to read this book. You're going to love it. Welcome back to Hope for the Caregiver.

This is Peter Rosenberger. Glad that you are with us. I've been doing a series on helping caregivers stay safe from all types of different things. Things that you might not expect, like what we talked about before you sign a prenup, make sure there's a caregiver clause. We talked about that. We've talked about all kinds of things.

People who will come and put all kinds of pressure on you to do things and make you feel guilty of the way you're caring for someone. And so we want to be very wise as we deal with the ins and outs and the challenges of being a caregiver. Part of that is your wallet. How is your wallet? How is your plan? What do you do?

What is going on with you? And I am very pleased to introduce to you someone that I think is going to provide some amazing insights for us today, Emily Boothroyd. And she is from Connecticut with Merritt Financial Advisor.

She is a wealth manager and partner, and they're nationwide. And I told you when we talked yesterday, I said, I want you to say exactly what you said yesterday, what you say that on the air today, because it was so powerful and profound. So welcome to the program. Glad you were with us. How are you doing? Thank you so much, Peter. I'm really happy to be with you. I'm doing really well and I love your podcast. I'm really excited to talk a little bit about this topic as it's a matter near and dear to my heart.

Let's jump into the deep end of the pool. What is something that you have seen in a trend that you're a little bit alarmed by and you would like to help folks tap on the brakes? By that, I mean, make better decisions. We tend to make knee-jerk decisions out of guilt, out of obligation, out of disorientation, all kinds of things as caregivers. What is something that you've been seeing that's causing you some alarm?

Yeah. So I'm seeing a bit of an alarming trend when it comes to a lot of my caregivers and frankly widows and widowers who have survived a spouse after a period of caregiving, where they're very focused on charity and on giving back to organizations. Now, sometimes those organizations may have been part of their lives through the caregiving process, or they may be a way of a caregiver finding a sense of self and identity outside of the caregiving relationship. Often they find themselves getting wrapped into being on boards and finding meaning in their life through participating in these charities. Now, in general, I think this is an absolutely wonderful idea to be participating in a charitable organization, to be supporting causes you feel passionately about. However, so often there are some mistakes that we all make, but caregivers in particular can be susceptible to, that lead them to end up spending way more than they have in the name of charity, in the name of help.

And I've seen several women get involved in charities, get promoted onto different boards. With every board, there's a charitable ask, can you donate this much? Can you participate in this fundraising event? Can you contribute meaningfully to our charity? Now very rarely does a charity or frankly anyone ask, hey, can you afford this?

Is this something that you can feasibly do? And so once a lot of these people are already wrapped up in this organization or wrapped up in this identity of being charitable, sometimes they will be depleting their savings at a rate that's just not sustainable. So that's something that I think is part and parcel of emotional investing, emotional spending, and not being able to separate the emotional self from the financial self.

And so that's part of some of the mistakes that I see caregivers make that I think that we should pay a lot of attention to. So when you encounter these individuals, what was a common thread? I mean, what was motivating them? Were they doing this out of a sense of being lost and now try to find themselves? Were they having a sense of guilt or obligation?

What's going on with that? I think it's a combination. I think we all search for meaning. And so often when we are in a caregiving relationship, even a spousal relationship, even a parent relationship, right? We tend to lose ourselves in the act of caregiving and the act of looking after others. And so there will often be a sense of, you know, needing to belong, wanting to give back and wanting to be a part of something that's bigger than you.

And I think that's a wonderful feeling, a root feeling, right? However, when we begin to conflate our identity, who we are with organizations that we support, who we are with how we spend money, I think it makes it harder to say no. And I think that we have some people who can be very vulnerable who are in a place where they are just trying to kind of find an outlet, just trying to belong, where they're getting pulled in and asked to spend more and more. And there is an issue with boundaries and being able to say no. And often many people don't know if they have enough to give, right? They'll say, Oh, I think I have enough, but they haven't done the planning work that's necessary to actually know how much they can give without hurting themselves. And I'm sure that's something you talk about is so often when we're in a caretaking and caregiving relationship, we don't put our true self first, right? We might say this feels good to do this, but really putting yourself first sometimes means checking in, finding a budget and figuring out, do I have enough to be able to participate in this way?

Imagine living on a budget, given our country's 30 plus trillion dollars in debt. That's an alien concept. Stewardship is actually a word we use a lot on this program. Stewardship, not only of our wallets, but of our bodies, everything about us and the caregiving world can be so depleting.

I think is probably the best word. It is important to pace ourselves. That's one of the things that you're seeing that's alarming. Is there something else that you're seeing that's the common trap for people to fall into maybe not even after the caregiver, but during the whole process or prior to what are some common missteps that people that you're seeing people make?

Yeah. I see really five common mistakes. The first is staying silent too long, right? We have so many people who involve themselves in a caretaking relationship. I see this particularly where we have spouses, where you are watching a decline of a spouse and the caretaking spouse is someone who really isn't used to handling the finances. Now, this doesn't have to be just a woman. This could be a man as well, but saying, hey, I really haven't done this before. But when a diagnosis is early on or when the issue is early on, not speaking up immediately and saying, I think in maybe it's a year, maybe it's 10 years, I'm going to be the sole person in charge of this.

I should start learning now. It's waiting, not wanting to say anything, not wanting to ask too many questions, not wanting to look as though you're trying to take something over. Staying silent too long can really be a problem because then you're having to climb up a big learning curve in a very short period of time. The second is trying to do it all. And I'm sure you've talked about caretaker burnout more times than you can count, but it tends to be that when we're in this caretaking mode, it's this idea, I'll do it all. I'll handle everything.

I'll take this over. Because sometimes I think we fall into that trap of if I want it done right, I've got to do it myself. That can actually add to a significant amount of stress and lead to a lot of balls being dropped. So it's really important to assemble a good support team around you who can help you to manage your finances and help you get a plan together so that you really know what's going on in your financial life without you having to spend all those hours.

Let me interrupt just for a second before we get to three, four, and five. People tend to mistakenly think they've got to have a bunch of money to start talking to a financial team. That is not the case. Not the case.

Explain that. So I think, listen, there are all different types of financial resources. There are plenty of people who, if you've got gobs of money and millions and millions of dollars, they will help you invest it. But I do think that there are a lot of really great resources out there, whether they are financial advisors, books, programs. There are so many resources for people to begin to get control over their finances. And so for people who don't have millions of dollars that they're focusing on investing, you can get a certified financial planner to help you build a financial plan.

There are fee-only planners who can just focus on putting together a feasible financial plan for you. And that could involve debt management. That can involve, you know, how much are you going to be paying for medical bills over time? That can involve, do we need to relocate? Do we need to remodel?

Things that may not necessarily fall under what people commonly define as a financial advisor relationship. Thank you for that. You know, a lot of people think, okay, I do have to have millions of dollars, but in my case, you can have millions of pesos, millions of pesos. And no, because I'm thinking about the cost of remodeling for handicap accessibility features, the cost of care to come. There was a survey the other day, not the other day, the other year of how many people want to age and die in their own home. And it's like over 90%. Well, that's not going to happen.

It's just simply not going to happen. Most people cannot sustain that. And if you bring in people to the home or the long, the more adaptable your home is, the longer you could stay in it, the more accessible your home is, the longer you could stay. That's just a general rule, but those things don't have to just be money thrown down some type of dark hole. You can structure your tax liabilities and all kinds of things with that, with proper financial advisement. Now that's not necessarily in your, is that in your wheelhouse?

No, no, that's not something that I necessarily do. Um, you know, when it comes to retrofitting homes and kind of, and, and, and looking at, um, however, um, no, I, I typically work on the investment management side. Um, but I do, I am a certified financial planner. And if you are looking for an advisor who can assist with that, I think the first step really is certified financial planner designation.

And that's a really great start. And I have been known to do flat, you know, financial plans for people, um, without managing money. So just helping them do exactly as you were saying, understanding how does this work with my tax situation? Um, over what period of time should I think about doing this?

Um, those are all really important questions that you can get a fee based professional to help you with. Well, part of building wealth is also managing debt. I mean, it's very hard to get wealthy if you're in debt. I've been sending letters to the white house about that recently. It's very hard to get wealthy if we're in debt. Uh, but as caregivers, I can't fix Congress in the white house, but I can certainly talk to myself and fellow caregivers about the importance of managing this.

And there are things that there are structures we can do in special needs, trust, all kinds of things that can be done, but it's very important to talk to somebody who is in this world to give you some good counsel. All right. That's, we got staying silent, trying to do it all.

What's the third one. Yes. Avoiding necessary information.

And this really kind of, you had a great segue there, right? I think, yes, so many of us want to age in place in our home and you said, Hey, that may not happen. So I think a lot of us don't want to face certain facts.

I mean, I know I've been there, right? You don't always want the information that you think you might get, but I will tell you that knowing and knowing early allows you to establish a plan B right. And, and many people in the caretaking relationship, this wasn't plan a right.

You weren't going, Hey, can't wait to be here. Right. So I think you really want to try to embrace plan B, plan C, plan D work with professionals to say, okay, I wanted to age in place. However, um, if I have this home, that's worth, you know, X dollars, and I don't have enough in outside assets to be able to support myself while I'm living in my home, what are my options with regard to this and how early can I find this out so that I can get my plan together?

Um, it's also a lot easier to move out of a home when you're a little bit younger than it is when, when you're, you know, further along and you're more reluctant to leave. So getting the information early, facing facts with someone who's not just going to say, Hey, doesn't look good too bad, but it's going to say, yes, it doesn't look good as it is, but here are several different avenues that we can walk down to help you get a solid plan in place. We're talking with Emily Boothroyd of Merritt Financial Advisors. We got to take a quick break. This is Peter Rosenberger. This is hope for the caregiver.

We'll be right back. This is Peter Rosenberger and I'm really excited to tell you about my new book. It's called a minute for caregivers.

When every day feels like Monday, I compiled a lifetime of experience to offer a lifeline to my fellow caregivers. Each chapter only takes one minute to read them. I know I timed them. You can read them in order.

You can read them out of order. You can flip to any page and you're going to find something on that page. So it'll help you at that moment.

It's called a minute for caregivers. When every day feels like Monday, go to hopeforthecaregiver.com slash book, hopeforthecaregiver.com slash book, and you can sign up. We'll let you know as soon as it's available for pre-order. We'll send you a special bonus feature for it, sample chapter, all kinds of things. Go to hopeforthecaregiver.com slash book. I can't wait for you to read this book.

You're going to love it. Welcome back to Hope For The Caregiver. This is Peter Rosenberger. This is the program for you as a family caregiver.

That is my wife, Gracie from her CD Resilient. You can see more about that at hopeforthecaregiver.com. We've been talking to Emily Boothroyd of Merit Financial Advisors. She's calling from the great state of Connecticut.

And in the last block she was going through a lot of the common missteps. And while we're on that subject, Emily, I wanted to touch base with one of the things you mentioned about building homes and so forth. Don't build your master bedroom on the second floor. If you're building a house and you're in your thirties and forties, or more certainly if you're in your fifties and sixties, as we get older, just write this down, stairs aren't our friend.

And if you're building one, go ahead and make handicap accessible features on the front end, wider doorways, all that kind of stuff. Don't just stick your head in the sand. I think one of the things I see Emily is that people will think, okay, I'll just take care of this for five or six, seven years.

They're either going to get better or they're going to go on to be with Jesus and then I'll worry about this stuff. And I'm like, no, no, we need to, we need to have that conversation today. So thank you for number three.

All right. Number four. So number four is making emotional decisions about money. You know, we talked about the charitable example of really conflating emotions, trying to find offensive self. I see people who either dive into charities or they might kind of start to spend, even though they know they don't have the money to be spending what they're doing, but it feels good, right? They're getting their outlet.

They've got their retail therapy. They're blowing off steam and doing it to their own financial detriment. I also see self-care being a bit of an issue where we keep saying, oh, self-care, self-care, putting yourself into a debt spiral because you're, you know, treating yourself because of your stress doesn't equal self-care. So sometimes self-care is a little bit of kind of facing the facts and really focusing on the data. And then also, you know, feeling like you have to stay in a certain home or your children will be so upset if you move, or you'll upset a family member if you relocate to a place that's actually better for you, better for your spouse, better for the person that you're doing the caretaking for.

Spending on certain items or supporting family members that you really can't afford to support, right? But you feel bad, you feel guilty, you feel pressured from other sources. Those are emotional decisions that can really adversely impact your bottom line long term. And so that can be really problematic. And I always like to get down to the hard data and then we can merge it with some of the emotion.

You're never going to have zero emotion in spending, but trying to really identify where the emotions are is a very important part of financial planning. Well, and as someone who has messed up in that area, you know, when you've done this as long as I have, you, you, you have ample time to make a lot of mistakes and I have, and it is so important. I think one of the things, and I'm pretty sure number five will have the same denominator. All of these things that Emily's telling us involve talking to someone else, not listening to your own thoughts by themselves.

You know, let's, let's get some fresh air in this place and have some other voices. All right. Number five. So the last one is stop looking in the rear view, right? So it's so easy to go back over your life and go shoulda, coulda, woulda. You know, I wish that I bought, you know, a lot of Apple back in the day, you know, that's not a stock tip, but you know, you're, I'm always looking back going, Oh, should have done this.

Shoulda done that. But I think it's really important to say, start where you are. Start exactly where you are. Don't get caught up looking in the rear view mirror. Don't beat yourself up for past mistakes. Try to look forward and say, how do I begin again?

Intelligently with a good sale for me. We're looking at that several exits back for me, but that I get it. No, I mean, I've had to learn to make peace with the fact that I should have done such and such, you know, but this is where caregivers are. And thank you for that because I think, I think that we treat ourselves. I wouldn't hang around somebody who treats me the way I treat myself.

And I think this is a great piece of advice for caregivers. Okay. Here's where we are. Let's don't romanticize or regret the fat, the past. Let's don't fear or fantasize about the future. Let's just deal with where we are and start today.

Today's a great day to start being healthy. And that's what you're saying. And I thank you for that. Yeah.

Yeah, no, I think self care to me, when we keep talking about our, our, our whole, the whole country is talking about self care so much to me, self care, stop beating yourself up, be nice to yourself, give yourself the gift of focusing on the future in a really intelligent way to put yourself in the best possible position to reduce your overall stress and have a good plan moving forward. It's not as nice as a bubble bath sometimes, but man, does it feel good when you have your ducks in a row? Well, unless the ducks are in the bubble bath, if you have found what Emily is saying to be piercing right through to your situation, you can reach out to her, her email eboothroid, eboothroid, E-B-O-O-T-H-R-O-Y-D at M-E-R-I-T-F-A.com merit financial advisors, merit F a.com. And I'm going to put this in the podcast as well.

So you'll have that information. If you want to go out to our podcast and hope for the caregiver.com. Emily, I want you to know how much I appreciate you raising the flag. And saying, Hey, Hey, Hey, Hey people, this is the path to safety is that's what we're all about.

And we get, we get hurt. I mean, these are very serious situations that so many are dealing with now and they're overwhelming. And it's really great to have a calm, reassuring voice of reason in this. So thank you so much. Thank you. It's my pleasure. Thank you so much for having me. Yes, ma'am.

Whisper: medium.en / 2023-05-12 16:48:24 / 2023-05-12 16:57:40 / 9