Jerry Garrett. Jerry's on the phone with me today. Jerry has been working with me on some financial plans. One of the things we like to do with caregivers is provide a wide variety of things to help you along your journey.

And sometimes it means just sitting down and talking about things with a financial representative, somebody who's dealing with insurance policies and all those kinds of things. And Jerry's done that with me and helped me kind of reorganize some things. And Jerry, you with me? Yes, sir. All right. I can hear you just fine, Jerry.

You're a beautiful person. And don't you appreciate big time, but y'all have an entertaining radio show. Let me start. Well, we do the best we can with what we got here. And the insurance world has changed dramatically in the last 20 years, hasn't it?

Yes, sir. It has. And let me start out by saying when I got into it, you had your traditional term type policies, 5, 10, 15, 20 year term. And then you had your permanent policies like your whole life and your index universal life. Now they also offer a guaranteed universal life, which is huge because you can actually designate the age which you want that to end.

You can take it age 100, you can take it age 65 to 80, so on and so forth. But one of the best things that they have added to the insurance industry is living benefits. And as you well remember, that's one of the reasons why you chose a plan that we designed for you.

I did. And what that means is if you get a chronic illness, a critical illness or a terminal illness, you can accelerate that death benefit. Well, let me interrupt real quick. Why is this important to caregivers is because a lot of caregivers are so busy taking care of somebody else, they somehow think that they're going to outlive or be healthy throughout their entire caregiving journey. And things can really go south on us pretty quick. I mean, sometimes we're one broken leg away from a Greek tragedy. Absolutely.

And another thing here is something that you may not know. Two-thirds of the working population plan for retirement, but they don't plan for a catastrophic health event. Right. Well, and those of us who are caregivers are already taking care of one catastrophic health event. Exactly.

So what are we doing to protect ourselves? You know, and what these things have done, these are actually pretty affordable. Now there's disability insurance, there's long-term care insurance. This is something even different and it's pretty affordable, isn't it?

It's very affordable. As a matter of fact, they just added that within the past, I want to say three to five years to term plans. And there are a number of financial advisors that are going to suggest that you buy a term plan and invest in the rest, so on, so forth. But what happens here, say you have a husband and wife, they get a $250,000 policy each, and then 10 years down the road, the husband has a massive heart attack.

Well, what they can do is they can tap into that death benefit until they get back on their feet. And this is absolutely huge. And that's one of the reasons why you chose the plan that you have. It is indeed, Jerry. And you, you kind of walked me through it and it is, it is affordable.

Now I got to, let me back up again here. A lot of us as caregivers think that we've got to go out and get all types of stuff and get loaded up. We can't always get everything we want as far as our insurance and all that kind of stuff, but we can do something. And there, you don't have to do, you don't have to go out and spend a thousand dollars a month to have all kinds of coverage. You can back it down and just do it incrementally and start, just start doing something because in the event something happens to you, what happens to your monthly income?

What happens to your family? There, there are all types of options now that you have because the marketplace, the demographic has changed so much. And a lot of these healthcare plans and insurance plans and everything else have adapted to meet that. And this is what Jerry's talking about. And so I, I just, I'm pushing this as hard as I can to folks to give them an option to do something. Don't, don't just throw up your hands and say, well, I can't afford this. Let, at least look at it and then take an opportunity to explore it. Because the bottom line is something is better than not having anything whatsoever. I mean, you have plans that even start at $25,000 worth of coverage and can go up, but something is better than nothing. Well, Jerry, Denny has a question for you.

Denny, go ahead. Yeah. Regarding the, the chronic or whatever that, that illness is or, or infirmity that causes you to want to cash in on this benefit. Does this need to be something that is permanent in your life? For example, I had a knee replacement once. I got better, but for about two months there, I couldn't drive.

If I'm a caregiver, I'm her wheel, so to speak. Is that something or does it have to be something that is considered permanent and always going to be a problem for you? Well, that's why they say that you can, with the accelerated benefits, you can use a partial part of that because whatever part you use from the policy is going to be deducted from the face amount. Or if it is more of a permanent plan, if you're using it to actually grow cash value, it can be deducted from that. But, uh, it depends on the individual and the scenario because different people are going to have different types of situations.

And that's why I suggest that you get with a licensed agent that can walk you through these things. Just like I walked Peter through his, uh, Peter got the plan that said, yes, let's go for this. This is what I'm happy with. And, uh, you get somebody that's knowledgeable enough that can answer all your questions. Well, and I've got great coverage on my hair, John. Yeah. As you should. I mean, I had to, I had to write that policy. I mean, the deductible is mighty high though on this hair coverage, but it's like a motley clue writer. But no, and Jerry, this is a huge service to folks. I think it's, it's so important. I think I see that more and more companies are providing easy steps into this.

You can't always get everything that you want. I think somebody said that. What's that?

The Rolling Stones. We did all of our transitions over the internet and the phone and at your convenience. Yeah. I mean, it was not a, it was not a, uh, a laborious, uh, or, uh, laborious laborious. There you go, John.

John just corrected me. Uh, it was not a laborious, uh, event for me. It was something that was pretty smooth to do. And it just gave me a little bit more. That's what insurance is, by the way, it's peace of mind knowing, okay, if something really squirrely happens, we've got at least this going on. And, and that's so important to us as caregivers to know, okay, because there's too many, there's, there's, there's, there's no margin for error and there's too many opportunities for error. And, and that's what we've got to work on. And, and, and so this is an easy way for you to take advantage.

Exactly. And, uh, Peter, and I've told you this before, I want to thank you for, uh, trusting me and, uh, allowing me to be of service to you. And, uh, if you have anyone there in the, uh, uh, listening audience that would like more information, I would be more than happy to help them. What's the best way people can call on them. They may be outside of this audience. I mean, this area in Nashville, but you can direct them on a national level to where they need to go. But if somebody had just a follow-up question, Jerry, what's the best way?

Just use Jerry W Garrett at gmail.com. All right. Well, is that Garrett with two T's? Two R's? Yes.

Two R's and two T's. J-E-R-Y W-G-A-R-R-E-T-T at gmail.com. All right.

And we'll put this in the, uh, podcast and put this out for folks to take a look at and see. Jerry, I appreciate you very much taking the time to call on this today. And we're going to talk to you some more about this down the road, but it's just one more tool to put in the tool belt of a caregiver to say, okay, here's how we do it. And you don't have to spend a fortune.

I'm not, I'm not spending a fortune with this, but it's a very good product. I've got several things in my financial kit that I try to do, and I've got more than I'm going to try to do. Even, even the rest of this year, Jerry, don't, don't get excited now, Jerry, but it's, uh, easy, Jerry.

Whoa, big fella. Tell Ms. Gracie I said hello because she, it was, uh, it was the reason why Gracie actually put in for the, uh, the quote that, uh, you know, that I contacted you. So please tell her I will do that. And, and, and thank you for that again, Jerry, just to helping us stay a little bit financial, uh, financially healthy as we journey down this road. It's hard enough being a caregiver.

It's harder to do it broke, you know? And, and so there's no need to put yourself in that kind of situation. We got more to go, but Jerry, thank you for the call on that. I do appreciate that very, very much. And we'll see you next time.

All right, Jerry. Thank you so much. So y'all have a great rest of the day and God bless. All right. Thank you.

See, Danny, this is little things like that, that we try to do and, and that's a great point. It's not something I would have thought of, but you don't think insurance. You're thinking, how am I going to get through this and health insurance? You're thinking about that all day long, but not life insurance. Well, and, and it's, and, and now that they've changed the marketplace to help us have options that we didn't have before. Right.

Before there was just really, you know, kind of sorry term policies or expensive whole life policies. Well, I think you've got more people being caregivers of the days and they're just going, Hey, maybe we should do something for that too. And, and, and so it's, it's, you know, one of those things, uh, by the way, if you want to follow along the show, it's on Facebook live and, uh, but we got a little bit of the videos is stalling out on the internet or something. I think everybody was downloading something for the NFL draft. We had a little activity in Nashville this weekend.

I think we broke the internet. This is true. And I have a face for radio and that might be messing things up too.

It's not used to that kind of, it's, it's used to your hair. And, and, and, and will it should be. Well, you know, we've got a, and then this, this show, for those of you just joining, please understand.

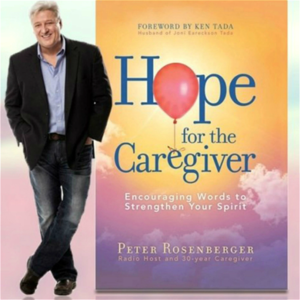

God love you for your lack of judgment. Hope for the caregivers, that conviction that we as caregivers can live a calmer, healthier, and dare I say it, a more joyful life. That is the conviction that the show brings. And, and I, I need to hear that just as much, if not more than anyone else. And so I'm saying it over the air waves is as much as I possibly can because I know what it's like to be in those isolated moments when you are just drowning in despair. I get that. I understand that feeling in ways that I hope many of you, I mean, I hope none of you have to do, but I do get it. And so I've, I've committed to going out there and, and speaking life into the world of the caregiver.

But part of that is to lighten up. And that's our caregiver tip of the day earlier that you heard. And, and that's why I enjoy having Denny here because he, he, he pops these things. And John too, I remember when we first started doing the show, WLAC told me that I do it here at WLAC in Nashville.

Now we're of course national, but they said, don't ever script the show. And I said, well, that's not going to be a problem. You know, don't write it. Oh, great. And I come in here with sometimes a scrap of a napkin with my notes.

But that's, that's impressive. You came in with a scrap of a napkin? Well, I was prepared. But I was, I was frustrated at times when I started just staring at the wall and speaking and you just never know kind of what's going on. And then all of a sudden I turned to the glass and there's John over there and he was actually listening to the show, producing the show, but he was actually listening, which I would, or at least pretending to. And so I, I, I started talking with John and I realized how much I was getting out of just that banging ideas around with someone else.

And then when you come in and say, this is not your first time here. And then you and I talk outside of here and we just bang ideas around and you just get, you, you, you become sharper and stronger. And I, what's the word I'm looking for, John? More robust. Robust. That's way better.

From the $6 column on the big board of words. Jerry, tell him what he's won. He's won some robust synergy. As a caregiver though, it, we've got to do this together. We've got to. So Denny, thank you for being a part of this with us. Thanks for letting me be a part of it.

And that's dennyvoices.com. And then we'll have the stuff for Jerry that you can go out and ask him some questions. Well, all of it's at our podcast, which is at hopeforthecaregiver.com. It's a free podcast and we'd love for you to take advantage of it.

Go out and download. We put out not only the whole show, but we'll put out clips of the show to make it easier for your listening audience. And we want to make it stuff readily available to you, however we can. So thank you for being a part of this.

We got more to go. Don't go away. We'll be right back. This is Hope for the Caregiver. This is Peter Rosenberg at 800-688-9522. We'll be right back.

Whisper: medium.en / 2024-01-22 07:37:29 / 2024-01-22 07:43:50 / 6