Welcome to Hope for the Caregiver.

This is Peter Rosenberger. This is the nation's number one show for you as a family caregiver. For those of you who are staying up late at night doing laundry, cleaning up, back and forth to the doctor's office, back and forth to rehab centers, back and forth to the pharmacy, on the phone with the pharmacy, on the phone with the doctor's office, doing all the things that caregivers do and cleaning up and then sometimes just banging your head against the wall. We are glad to have you with us. Take a moment from hitting the wall.

Take a moment from talking to the ceiling fan and just hang out with us for a while. We're glad that you're with us. As always, I am thrilled to bring himself, the Baron of the Board, Assaulted to Sound, the man who just is lovely. He is John Butler, everyone.

John Butler, the Count of Mighty Disco, and he's so tall. I need that file immediately. Like, I needed that yesterday.

What did you do? Well, I had my friend Hank Martin, who is a world-class jingle singer. I mean, he did stuff back in New York in the days when we did a lot of jingles.

We don't do jingles like we used to. And he did like, Red Lobster, we'd know how to do seafood. I mean, that was him.

And GE, we bring good things to life. You know, he did that. That was him. And he did this for you. He did this for you. I played the keyboard, but he did that for you. So, we have laughed about this all week long. I could wait until Sunday.

And he's so tall. But anyway, listen, we have a, I'm doing well. It's a beautiful day. We had snow yesterday and it's a beautiful sunny day today in Montana. And I just got in from feeding the horses and I'm a little bit verklempt.

So, you have to bear with me because I may do that. I wear a mask while feeding the horses. It has nothing to do with COVID.

It has everything to do with hay. Well, it was so nice out here. I mowed the lawn today. Well, congratulations. We're a ways away from lawn mowing here.

We probably won't do that until after Memorial Day. You laugh. But if it gets a little out of control, I fence off the driveway area so they can't get out. I let them just graze around here. But boy, it makes landmines.

They have to walk through sometimes. That's a different story. That's barn life, horse life. But I am thrilled to have on the show today, Jason Neufeld.

He is an attorney from down in Florida and he deals with elder law. And this is a big subject affecting so many people right now as we have this aging baby boomer population. And last I checked, John, the aging rate in this country is 100%. The mortality is as well.

Yeah, on a long enough timeline, the life expectancy of everything drops to zero. It does indeed. And so, I really appreciate him coming on. So, Jason, welcome to the show. We're glad to have you with us. Peter and John, it's good to be here. Thanks for having us. All right. Tell me this. Let's just start off with the basics. I'm going to ask you some basic questions. I'm going to assume that nobody knows anything about this at all. That's good.

It has a fair assumption with us. Why elder law? What is it that's different about this and dealing with caring for the elderly legally and the needs of the elderly versus anything else? Why is this such a specialty? Yeah, I think that it's a great question. When you're dealing with a senior population, they just have needs that are so much more different than everyone else's.

Some of them are the same, right? We do some typical estate planning stuff like the wills and the trust and the powers of attorney. That's all important. But aside from that, especially as we age, they have needs like they're thinking about long-term care, whether it's in the home or whether it's in the facility. Elder law is not just for the elderly. There are folks who are younger than the age 65 that I work with who are disabled. They also have their own special needs and long-term care concerns as well. We're talking about elder law. That's really what we're talking about. It's part estate planning and then part long-term care planning oftentimes in the context of Medicaid.

All right. Go deeper with that with Medicaid because what happens if there's an estate involved, particularly, and it's okay to veer back into, and I appreciate you bringing it up, the families with special needs children and so forth. When there's an estate involved, what about what happens with Medicaid and other types of government, potentially government benefits? Yeah, so first of all, I think it's important to mention, a lot of people get this confused that Medicaid and Medicare are two different things. Some people know it rock solid. Other people kind of think they're interchangeable.

I think it's important to start there. Medicare is what we all get when we turn 65. If you worked in the United States and you're a citizen or you've been paying into the system and that helps pay for hospitalizations and seeing doctors and depending on what plan you get prescriptions and things like that. When people hear Medicaid, they are typically thinking about a health insurance program for those who are disabled and impoverished.

In my world, it's not always like that. In my world, we're thinking about Medicaid because people, as they get older, their need for long-term care is of course going to increase. Medicare, again, what everyone typically gets, has a very limited long-term care benefit.

Whereas Medicaid, if you can qualify for it, actually has a wonderful long-term care benefit. This is across, I can only speak intelligently about Florida. I'm only licensed in Florida. I only practice in Florida.

That's what I do. Medicaid is a state and federal program that differs a little bit nationwide. Medicaid will pay for some home health care or at least a portion of an assisted living facility bill or the entirety, basically, of a skilled nursing facility or rehab facility. When people are talking about these sort of needs, again, they hear Medicaid and they go, I'm putting it frankly. They think to themselves, I'm not poor enough to qualify for Medicaid.

I go, yeah, I understand. That's why you're coming to someone like me who is able to legally and ethically protect your income and protect the assets that you've worked your whole life to accumulate and still get you qualified for these Medicaid long-term care benefits. I'm going to swerve from elder to special needs for just a minute because if you have a special needs child that is not necessarily dealing with a terminal affliction, for example, Down syndrome. And I have a friend of mine who's been on the show with several times who has a son now who's over 40 with Down syndrome. My friend's over 70 and he's starting to realize, it's dawned on him over the last several years that his son may very well indeed outlive him.

That didn't used to be the case with Down syndrome because the heart issues that they went through and so forth brought a life expectancy down to less than 30 for many, many years. And now here he is over 40. And my friend has an estate. He has, he's a songwriter. He has a lot of royalties and things such as that.

And so how does he work out leaving this and then having guardianship and all those kinds of things. And this is where, this is where you live. This is your work, isn't it? That's right.

Yeah. Well, you just hit upon the exact intersection between estate planning and Medicaid planning, because if you go through like a typical estate plan, right, let's say, let's say you just have a will, or maybe you just have a standard revocable trust. Oftentimes that is worded if you're not planning properly or maybe because you don't need it.

It's not necessarily improper. Some people just don't need to consider special needs children, right? And the will might say, when I pass away, everything goes to my kids. It probably says, if you're married, it probably says everything goes to my wife or my spouse. And then when she or he passes away, then everything to our kids equally. But that's a real problem if one of your children or even your spouse, by the way, is a special needs individual, someone who has some kind of physical or cognitive disability that if they are benefiting from needs-based public programs, such as social security income and Medicaid, because if they receive this inheritance directly, they will then be kicked off of those programs because in order to qualify, you have to have, you have to meet these asset and income thresholds, right?

If you have more than a certain amount of money, you don't qualify for these programs automatically. So with proper planning though, you can make sure that your heirs benefit from your, your assets and your bounty and still not knock them off of their need-based public benefits. And typically we're doing that through a mechanism known as special needs trusts.

Exactly. And I talked to several folks about this, the importance of, and a lot of times I'm finding, and you tell me if I'm, if I'm hitting the mark here, but I'm finding that grandparents, for example, will initiate these kinds of things that have, they have, they, you know, have assets and they want to set up that special needs trust for that grandchild who has special needs, knowing that the parents are working hard to be able to take care of this child. And this will help funnel that income a little bit better for that child. It doesn't knock them out of, like you said, knock them off of Medicaid or anything like that, but then they will be looking to the needs of that special needs family member that particularly a grandchild, for example, are you seeing a lot of that kind of thing?

Oh, a hundred percent. And, and it's, it's, it also highlights the importance of not, you know, if you're planning for your own special needs grandchild, well, now you have to make sure that anyone surrounding that grandchild, any way that that grandchild could potentially receive money, they're doing the same thing, right? Because if uncle John wants to give his special needs, nephew a piece of his inheritance, well, again, he may with wonderful intentions, provide for his nephew, especially the nephew in his will.

But again, that just kind of creates the same problem that we just talked about, right? If it goes directly to special needs, nephew, especially nephew is kicked off a benefit. So it's not only grandparents requiring for grandchildren, it's not only parents providing for children. Anyone surrounding the special needs individual that could, that may be potentially interested in providing for them, they have to do that same planning as well.

And the reason I'm glad you brought that up is because a lot of parents may be grateful that their child is named in the will, but they need to think through this thing. Can they set up a special needs trust after the fact kind of thing? Yeah. If a child inherits a quarter of a million dollars, for example, and then the family's like, oh, my goodness, we need to act quickly on this. Before that money is really taken receipt, can the family quickly move and set up a special needs trust to avoid that child being kicked off of Medicaid and so forth? Is that okay to do that?

Yeah. So if the child, the special needs child has already received their inheritance, you can still use a different type of trust that is just not as advantageous as if you dealt with it in advance. Because the idea is that if it's your money and you're the special needs individual, and you take your money and put it into a trust, by law, it must be the type of trust that has what's called a Medicaid payback obligation where the trustee would, once that special needs child passes away, if there's money left in that trust, the trustee is obligated to notify the state, the state sends a bill and they have to pay whoever's left in that trust back up to the amount of the bill. And only if the bill is satisfied, then do other people get to inherit, to compare that with if you plan in advance and you take someone else's money, whether it's parents' money, grandparents' money, uncles' money, and instead of giving it to the special needs individual directly, you put it into a trust for that person.

That trust can be designed so that there is no Medicaid payback obligation. So again, the answer is there's always a solution, but it may not be as advantageous once they've received the money. And is there, real quick before we go to the break, is there a time limit on that? I mean, do you have 10 days, 30 days, six months?

No. As far as once they've received the money that you have to set this thing up or? Yeah. Once they've received the money, typically you have the rest of the month to figure out what you're doing with that money.

And if you still have money in there following months, there's going to be issues. Okay. All right. Well, hold on. We're going to get into this a little deeper here. We're talking with Jason Neufeld. He's an attorney in South Florida and talks about elder need laws and also for special needs for children and so forth, family members. This is a very sticky wicket for us as caregivers. That's why you've got to have experts like this.

And his website is elderneedslaw.com. Don't go away. We got more to go. Have you ever left the stove on? Oh, be honest.

You know, you have, we all have. And the smoke fills up the kitchen. The smoke detector goes off. The dog starts barking.

The phone is ringing and there's pandemonium everywhere. How'd you like something to avert that? Well, there's a new invention called fire avert, and it plugs in to your stove and it pairs with your smoke detector.

And the moment the smoke detector goes off, it shuts off the heat source to the stove, gas or electric, and make sure that it doesn't turn into a fire. We have a lot of things going on all the time. And a kitchen fire is not on the list of things that we need to be stressed out about. Let's take that off the table.

And what about your loved one who's living alone? Or what about families with a special needs child who may accidentally leave aluminum foil on the plate, put it in the microwave or a fork on the plate, and it starts smoking up? These are things that we can avert with fire avert. F-I-R-E-A-V-E-R-T. Go out there and look at it today. It was invented by a fireman who got tired of being called to homes and seeing all the damage that could have been avoided. And so he came up with a great idea that did this. And guess what?

It's working. And hundreds of thousands of homes across the country are using fire avert. Let yours be one of them. Fire avert dot com. F-I-R-E-A-V-E-R-T dot com. Use the promo code CAREGIVER and get an even greater discount than the already low price. It's a great gift to give to yourself, to a loved one, and to a caregiver you know. Fire avert dot com.

Promo code CAREGIVER. Have you ever struggled to trust God when lousy things happen to you? I'm Gracie Rosenberger. And in 1983 I experienced a horrific car accident leading to 80 surgeries and both legs amputated. I questioned why God allowed something so brutal to happen to me.

But over time my questions changed and I discovered courage to trust God. That understanding along with an appreciation for quality prosthetic limbs led me to establish Standing with Hope. For more than a dozen years we've been working with the government of Ghana and West Africa, equipping and training local workers to build and maintain quality prosthetic limbs for their own people. On a regular basis we purchase and ship equipment and supplies.

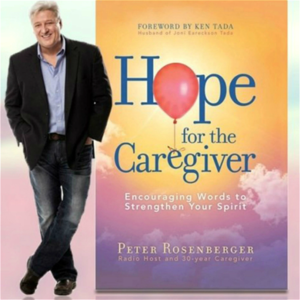

And with the help of inmates in a Tennessee prison we also recycle parts from donated limbs. All of this is to point others to Christ, the source of my hope and strength. Please visit standingwithhope.com to learn more and participate in lifting others up. That's standingwithhope.com. I'm Gracie and I am standing with hope. Welcome back to Hope for the Caregiver. This is Peter Rosenberger. This is the show for you as a family caregiver. That's Gracie, my wife, off of her CD Resilient.

Go out to hopeforthecaregiver.com and see how you can get a copy of that CD today. We're talking with Jason Neufeld. He is an attorney in elder law. I keep wanting to throw care in there because that's what I do here.

And he is in South Florida. And Jason, in the few minutes we got left here, I wanted to ask you kind of an obtuse question. John, I worked that word in today. Obtuse. Oh, so willfully ignorant is what you're saying.

Well, I am willfully and well, never mind. But I want to ask you, what are some common mistakes that people make in pursuing this type of path when they're looking at stuff like this? What are some common mistakes that you've found with folks?

Yes. So one of the biggest mistakes that people make is they'll give their money away. They'll give their assets away. They'll say to themselves, I want to qualify for Medicaid, which typically says you can't have more than $2,000 in what Medicaid considers to be countable assets.

Now, luckily, not everything's countable, but everything in the bank account, the brokerage account, all that stuff is countable. And so they'll go, you know what, gosh, I want this benefit. And I know I can't have more than $2,000. And I have, let's say, $100,000 in the bank account. I'm going to give $98,000 to my kids because I want them to get my money any way. And I want to qualify for this Medicaid.

So everything works out well. Well, unfortunately, Medicaid got hit to that a bunch of years ago, and they instituted what's known as the five-year look back period. And when you apply for Medicaid, you give the government the ability to conduct their own background into your finances. And if they find, well, first of all, they're going to ask you, have you given anything away in the last 60 months or five years? And, you know, it's a felony to lie to them. So no one wants to do that. But if you decide that you want to risk that, yeah, if you decide you want to risk that, you're still signing something that says they have the right to do their own investigation.

And they often do. And if they find you've given assets away within five years of applying, they're going to disqualify you for a period of time. So you want to make sure you're not giving things away. And I tell people, I go, listen, I can get Bill Gates onto Medicaid if he gave me really if he really wanted to give me all the all the keys to his kingdom. Right.

I can get anyone onto Medicaid to help pay for all these long term care expenses. But there's a right and there's a wrong way to do it. And we have legal and ethical strategies to move the money around in a way that will not result in that penalty.

And people think that there's something, you know, weird and underhanded going on. I say not only is all straightforward, but we're very transparent with the government. We tell them exactly what it is that we did with the income or the assets.

And still why still under state and federal law, they still have to give my client these benefits. So we're not hiding anything. We're just, you know, I tell people, think about it like this. If you had 20 million dollars in the bank, you would be going to a fancy tax lawyer and saying, how can I pay as little in tax as possible legally?

Right. And I tell people, there's nothing wrong with that. There's nothing illegal about that. That's just what people would do. And I say, I'm doing the same thing because I'm doing it for, you know, working class, middle class, upper middle class folks to help save what they've worked so hard to accumulate. Well and it's not like the government is going to be a bad steward of our money. I would never dream to say that on the air, by the way, that the government would be a bad steward of our money. I would never dream of saying that in any way, fashion or form that a government that is allowed 30 trillion dollars in debt would be a bad steward. John, you were going to say something.

Oh yeah, no, no, no, no. But these are ethical because these are, these, the rules are there and there are different strategies like anything else. And it's not a zero sum game or anything like that.

It's just like here, like let's, we're going to be completely open and honest with everybody. And that's just a good strategy all around for lots of different situations. So, you know, this is, yeah, it sounds, sounds underhanded, but no, I, I, I, you know, and I tell people, I don't have a magic wand, right?

I don't have like that one thing that has no drawback. Everything I do has pros and cons and there's more than one way to skin this cat and everything I do has pros and cons. So when I'm meeting with a client and they're, they're disclosing their income and their assets, and then I'm presenting to them multiple strategies that are within the bounds of Medicaid laws. And then we're putting together typically a combination of strategies to, to move the money around and to get them qualified or their loved one. I'm dealing with many caregivers who are calling on behalf of their loved ones to get them access to resources that they didn't know they could have access to.

Last question here. A lot of people think wrongly so, but the stereotype is there that if I'm going to go get a lawyer involved, this is going to cost me a fortune. This doesn't cost a fortune to do set all this stuff up, does it? So it's not, it's not a fortune, it's not a fortune.

It's, I, I personally operate on a sliding scale. I try to make myself affordable to everyone. And if they come to me with, you know, someone who comes to me with half a billion dollars worth of assets they want to protect their case is just going to be more complicated, but the little they pay me is going to pale in comparison to the savings that I'm able to get them. Once I get them, um, help paying for their home healthcare or help paying for the ALF bill or the nursing home bill, you know, my fee pays for itself so many times over very, very quickly. So once I tell people how much I'm able to protect, they don't care about my fee because this is the best financial investment they'll ever make in their entire lives.

I mean, that's, you know, I speak hyperbolically, but they are... No, I think you're right. When it comes to this particular field, I concur with you. That's why I wanted to have you on the show because I know what this thing can solve and protect people from.

We never really know the pain of feeling what we're protected from, but I have seen people who didn't go down this path and it is horrendous what happens to them. And the, the bills that can add up when you're caring for somebody, um, not just in nursing homes and not just, you know, things such as that. There's so many different little bills there's that you don't really think about.

Transportation, specialized transportation, all these things can be paid out of a special needs trust that Medicaid may or may not pay. But if, but the point is, is if you don't set this thing up properly, you're going to get into some really ugly territory. And so you're providing a tremendous path for people to get some counsel.

I know you're in Florida. A lot of our listeners are going to be, well, actually I just had a pretty good size download audience, John, in Germany. I have no explanation.

I have no explanation. So to all the folks listening in Germany, thank you for being a part of the show. And, uh, so, but, but I want for those who are considering this, uh, Jason certainly has made himself available. If you want to reach out to him, email or whatever, and if you have some questions or things like that, or if you know somebody in Florida that you want to refer to him, uh, this would be a tremendous gift and it's elderneedslaw.com elderneedslaw.com and it's Jason Neufeld. And Jason, I want you to, I appreciate you being on the show with us today. I've had a great time. Thank you for having me, Peter and John.

I appreciate it. Tell your boys, tell your boys from me and John, both of us are pianists. Tell your boys, keep practicing.

He's got twin boys that are taking piano lessons. Tell them, keep practicing. Okay. I will. I absolutely will. I appreciate it.

Go be with your family. Thank you for taking a little time with us this Sunday evening. And I'm very, very grateful for you, Jason.

We'll look forward to having you on some more. Okay. You got it.

All right. Jason, Jason Neufeld elderneedslaw.com. This is Peter Rosenberger. This is a show for caregivers. Hey, let me ask you something. When you, when we come back from the break, John and I are going to talk about something that affects every caregiver. You've heard me talk about the fear, obligation, guilt, the fog of caregivers. We're going to, we're going to delve into fear. What are you afraid of? We'll be right back.

Hey, this is Peter Rosenberger. Have you ever helped somebody walk for the first time? I've had that privilege many times through our organization, Standing with Hope. When my wife Gracie gave up both of her legs following this horrible wreck that she had as a teenager, and she tried to save them for years and it just wouldn't work out. And finally she relinquished them and thought, wow, this is it. I mean, I don't have any legs anymore.

What can God do with that? And then she had this vision for using prosthetic limbs as a means of sharing the gospel, to put legs on her fellow amputees. And that's what we've been doing now since 2005 with Standing with Hope. We work in the West African country of Ghana, and you can be a part of that through supplies, through supporting team members, through supporting the work that we're doing over there.

You could designate a limb. There's all kinds of ways that you could be a part of giving the gift that keeps on walking at standingwithhope.com. Would you take a moment to go out to standingwithhope.com and see how you can give.

They go walking and leaping and praising God. You could be a part of that at standingwithhope.com. As a caregiver, think about all the legal documents you need. Power of attorney, a will, living wills, and so many more. Then think about such things as disputes about medical bills. What if instead of shelling out hefty fees for a few days of legal help, you paid a monthly membership and got a law firm for life? Well, we're taking legal representation and making some revisions in the form of accessible, affordable, full-service coverage.

Finally, you can live life knowing you have a lawyer in your back pocket who, at the same time, isn't emptying it. It's called Legal Shield, and it's practical, affordable, and a must for the family caregiver. Visit caregiverlegal.com. That's caregiverlegal.com. Isn't it about time someone started advocating for you? www.caregiverlegal.com, an independent associate.

Whisper: medium.en / 2023-12-12 23:56:28 / 2023-12-13 00:07:58 / 12