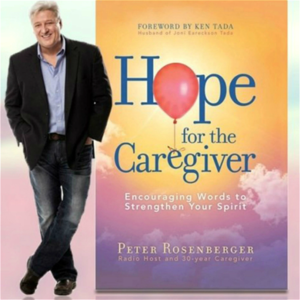

Welcome back to Hope for the Caregiver. I am Peter Rosenberger. This is the show for you as a family caregiver.

You know, part of our journey as caregivers is dealing with a lot of bills, oftentimes medical bills, durable medical equipment, home care, all kinds of things that are out there and it can be a huge strain. My name is Dr. Michael Grayson, PhD. He's the CEO of Credit and Debit Management Institute. Dr. Grayson also has the record for the highest recorded credit score of 990.

I don't have that. In 2014, he made the cover of REI wealth magazine as their editors voted him as the world's leading credit expert. And he's been credited as a man who created a myriad of millionaires by repairing individual credit scores. Does this sound intriguing to you as a caregiver?

Do you want to learn more? He's going to talk to us today about building your credit, surviving what can also be a very, very difficult financial journey as a caregiver. So I am thrilled to have him on the show with us today and I want you to welcome Dr. Michael Grayson.

His website, by the way, is build850credit.com. Dr. Grayson, welcome. How are you doing? It's a pleasure.

I'm glad to be here. How are you today? How's the snow where you are?

It's coming up. I mean, they're doing a job shoveling it, but it was a nightmare for a couple of days. But right now, they're almost done. They're almost done shoveling. You guys, I live in Southwest Montana up in the Rockies and you guys are getting more snow than we have.

I think it was 18 inches. We did have that right before Thanksgiving in November. But you know what they call a lot of snow out here in Montana?

Wednesday. Well, listen, I'm glad to have you here. Can we jump right into some things? This is your world, but tell me, what is a debt filter? Okay, so debt filtration, very important concept, gets little or no attention anywhere that I've seen. So a debt filter is a system of government programs and laws that are designed to eliminate your bad debt and to restore your credit simultaneously without payment, bankruptcy, consumer credit counseling or debt consolidation, credit repair, any of that stuff using cancellation and forgiveness.

That is the key word. If any of your viewers don't remember, anything else we talk about today is cancellation and forgiveness. That is the central idea behind debt filtration.

Well, being a man of faith, the cancellation of forgiveness is the cornerstone of everything I'm counting on. But these are not new laws. These have been around for a while. Our forefathers instituted debt filtration. So debt filtration is always on the books.

Each president has the ability to bring them in and take them out as they see fit. So when Obama first came in, there was a ton of new debt filters introduced because of the mortgage crisis and other issues. Now with COVID, during the Trump administration, they brought in the CARES Act, which is a very good debt filter. But one of the best debt filters that's always been around since the very beginning is called offer and compromise.

So if you have a tax liability, if you owe the IRS more than 20 grand, you shouldn't be trying to pay that debt if you are having financial problems. You should be filtering the debt. You know, what I teach people in my workshops and what we do for our clients, we teach them how to filter and not pay.

A lot of people are struggling. They can barely make ends meet and they got the IRS hanging over their shoulder, you know, and once you make a deal with the IRS, you know, those guys don't really care. They just want you to pay. However, you can bypass the payment method by going straight to debt filtration. So instantly, if you owe the IRS more than 20 G's, debt filter, you should be thinking debt filter, OIC. So if you don't know what proper debt filter is, Google it. If you had to guess, what percentage of people know about this sort of stuff in the country? I would say less than 5%. Wow.

Let me tell you why. Most people that understand debt filtration might use one debt filter and they take advantage of the fact that consumers don't understand it and they make a lot of money. Like debt collections is a multi trillion dollar industry built on misinformation.

So that is the problem. Where this hits home for my audience is a lot of times you've got a situation where a family member who has been impaired hasn't filed taxes or anything else for some time. They pass away and all of a sudden the IRS is knocking at the estate. Will this work for family members dealing with an estate situation? Okay, let me tell you how the estate situation comes into play. And I wrote a couple articles about this.

I had a client who I was doing a workshop and she started crying really badly. And what it turns out, her daughter had just passed away and left her $200,000. Now the problem is they passed a law that says all creditors have to be paid prior to dispersing through the beneficiaries.

Okay. So there was $197,000 worth of outstanding collections against her account. So her lawyer had called me up. She put me in contact with the lawyer. The lawyer said, I'm ready to start paying out.

I said, freeze. Do not pay a single person until I filter all of these debts. So we started across the board with every single one, implemented debt filter, and ultimately I think her total liability was like $20,000 once we filtered everything properly. So especially in estate planning, I drafted an addendum for wills so that people will make sure upon execution of the will, prior to paying any debts, they require that the debts be filtered first. So, because let me tell you one of the scams I uncovered.

So it's in this case. So this client had a $30,000 credit card that she didn't pay. You know, she's deceased, didn't pay.

No problem. The bank put in to the estate to collect, but they also passed the same debt to two debt collectors. So that's how I wiped out. So she owed $90,000 worth of collection just by filtering those three debt, but two different debt collectors. So what I found out, debt collectors have software to troll the newspapers or databases for deceased, and then they troll the collection database. And if you were in collections and you're deceased, they're buying it all up and they're just sending it in. Whether it's legitimate or verified, they don't care about none of that because the court pays them automatically. What a crime. What a scam.

And people don't know about this and they're just kind of... They just pay. If a collector sends in a bill to an estate, nobody cares, nobody verifies it, they just pay it. It is the biggest scam on the planet. Do you know how much money I can make to simply sending in debts to estates? I can just make it up and send it in.

You should be verifying every single one. And I think that this is going to increasingly be a problem as we have this aging baby boomer population, this massive aging population. And as they pass away, so many of the family members don't know these things. They don't know what's going on.

Dr. Grayson, I think that one of the questions everybody is asking, not everybody, but a lot of people are asking about anything. When you watch, I don't think there's any more news anymore. It's just all over the media. They don't report news. News is over.

I agree with you. But people are saying, who do you trust? Who do you believe? And when you get big famous actors to represent certain things on television, well, that sounds real whatever.

And nobody knows who to believe. And into this situation, you're coming in from the voice of experience. This is what you do.

This is what you do every day. And you're seeing these horror stories. Tell me, besides this woman that had the two hundred thousand that was weeping and she had outstanding things of one hundred ninety seven against it.

What are some of the things or what are some of the stories that have really touched your heart that you say we want a big one on this one? Well, let's see what one of the big things that our office does is called foreclosure abatement, foreclosure abatement. So foreclosure abatement means we step in, shut down the foreclosures and force the creditors to offer you loan modification. So back to an Obama administration, they passed a ton of a mortgage forgive. They passed a mortgage forgiveness at a ton of mortgage debt filters. So there's really no reason for anybody in America to lose their house to foreclosure, which sounds weird when you remember 20, 30 million people have lost their home to foreclosure in the past few years.

But legally, there's no reason. So we had one lady who had, you know, her one of our programs and she called me up and her family home was and this is not sad, but it just kind of touched me a little bit. It was kind of funny. She had lost her home and we were able to step back in and save them. She lost the home two years before and she was, you know, staying with relatives, bouncing back and forth, but she had lost the home two years before.

We were able to successfully overturn the foreclosure. The bank gave her modification and she hadn't been in the house in two years. And it was funny. She said when she drove up to the house, she couldn't see the door because the, you know, the overgrowth and the lawn had grown so high.

And I just thought that was funny. But that was like one of the most extreme cases, you know, because people say every day, you know, can you save my house? Is it too late?

It's really never too late because there's enough debt filtration in place to really, you know, save your home. Now, one other thing I just wanted, this is one of my clients had signed up for our credit program. They were referred to us and her and her husband had been in the program for like a month or two. And they start becoming a holy nightmare to our staff. They were calling, cussing, screaming at the staff. What the hell is taking so long?

Why am I not at 800? You know, I had talked to the clients a couple times like, listen, you only been in the program for a couple of months. You know, it takes some time.

He's like, well, you did my friend's credit in nine days or one month. And I tried to explain to everybody it's different. So one day, they came in and they were yelling and screaming at the top of their lungs. Now, my office is at the other end of the hallway. So the reception area, they were yelling so loud. I heard them around the corner all the way down to my office. And so I was like, call the cops because the staff was scared.

Her husband's really big and angry. And so I said, call the cops on them and have them removed from the premises. And then I thought about it.

No, no, no, no. Don't do that. Send them to me.

Send them to me. So they came in my office immediately. They're cussing and screaming. Her husband was real puffed up, you know, real angry looking guy. You don't want to meet him in an alley or something. Now, to be fair, you're not a big guy. Well, this guy was much bigger than me. So I was very scared, but I wanted to talk to them and find out why are you so angry?

We're not at a point where you should be angry because you've only been in the program for a couple of months. But they were cussing and screaming. They weren't listening to anything I had to say. But at a certain point, the wife was like, just forget it.

Forget it. And she started crying like a baby. She was crying. And I was like, huh? She just went from cussing me out. Now she's crying like a baby, the husband trying to console them. And I was like, what is going on with you? What is going on? Why are you so upset? And she said, if I don't get I'm in final stage of cancer.

If I don't get this special surgery or treatment, you know, my wife is going to die. And they're basing it off of our credit. Well, it hit me then. She's not mad at us. She's mad. The clock is ticking. The clock was ticking.

Man, listen. That was very sad for me because if we didn't fix her credit, she would have died. They based the treatment on her credit.

Were you able to fix it? We were, of course. So I told, I calmed them down and I told them, I said, listen, if it's not done by next month, you've been in for two months. You know, I'm going to talk to the team, make sure they expedite.

If it's not done in a month, come see me personally, because now I'm emotionally involved. So I kind of forgot about it because we were very busy. And then like two months later or something, I was in my office, my door was open, and I saw these two people walking around with a lot of stuff and they were laughing and talking to the whole staff. And so I called up front. I was like, because, you know, we got a lot of work to do. I don't play with my staff.

You know, you got to have time to play, you know, get back to work kind of thing. And so the people kept walking down and they were walking toward my office and I got up to close my door because I didn't really have time. And I didn't realize who they were. And then finally somebody walked them down to my office.

I was angry because I was like, you know, get them away from my desk. But I stared at them and I noticed it was that couple. But their whole demeanor had changed. You should have seen this woman. I didn't recognize them because she had her makeup done. Her hair was done. She was happy.

The husband was happy. You didn't know. But their credit had went up to 750.

They were immediately qualified for the program. Forget about it. They were done.

But their whole demeanor had changed. When you were getting your PhD, did you think you'd be dealing with family counseling? I would have never believed that credit, you don't see credit from this side of the table where it impacts people on a daily basis. I always thought of credit is just some construct.

And either you got it or you don't. You probably don't have good credit because you didn't pay your bills on time. I used to think that way. Until I start helping people and I start seeing the problems and the circumstances that lead to bad credit and I start seeing that people are not teaching you the right way to fix your credit because nobody wants you to have good credit. I think it's part of the systemic problem in this country.

We're not teaching people to be good financial stewards of their own life and what's available out there. I really appreciate what you're doing here with these folks. This is about as real as it gets when you're facing a surgery and it's looking pretty dicey and the money is crushing you. The credit, the money, the debt, everything. And my audience, we deal with lots and lots of medical bills. We deal with kids with special needs and so forth. I was looking at my own situation and I remember a family member told me many years ago, this was years ago, I've been doing this 35 years now as a caregiver.

This was about two-thirds into it maybe. He said what you and Gracie carry, it ruins people financially. It ruins them.

There's a lot of filters for medical debt collections. That is not an issue. Well, yeah, but you got to know them and that's why I had you on the show today because people don't know.

They don't even know the word. And so let's get the word out and let's let people know there is a path. To be fair, like you alluded with this couple, you didn't get here overnight. You don't get out of it overnight. There's work involved. There's real work.

But there's still work. But I'm just sharing what, like you said, there's light at the end of the tunnel. You just got to keep moving in that direction.

Yes, sir. There is a path. It may be a challenging path and it's a narrow and sometimes a scary path, but it is a path. And that's better than just blindly just writing checks or accepting your fate in these situations and being thrown out of your home when you've got, particularly if you've got a family member that's got special needs. The other thing is a lot of my audience, I do this with my audience.

I talk to family members of alcoholics and addicts because you talk about something that'll go burn through cash and credit and everything else. I know you've seen this. And so this is why I wanted to let people know how to protect themselves, protect their assets, protect their home. It's like this couple that came in your office, protect their sense of well-being. I mean, they were truly coming apart at the seams to the point where they almost got arrested.

Yes. Now, that wouldn't have helped their credit to get arrested. I mean, I've never in the history of credit, I've never heard of anybody improving their credit by getting arrested. So any last comments you want to say to folks? Because people are scared. They don't know what to do. They don't know who to trust. They don't know who to even call or what to go. Last thing from your heart.

Okay, I want to leave this with everybody. One of the best new debt filters that's out there, the CARES Act. So the CARES Act has a credit protection provision. So if you've been affected or impacted by COVID-19, you should be calling or writing to every single creditor that you have and asking them to defer your payments for three to 12 months. The beautiful part about that is it now gives you an opportunity to save some money and create some discretionary income.

But even more importantly than that, if you were late on any of those payments, the law gives you a provision to clean all the late payments off of your credit. So if your viewers simply do this one thing, they can boost their credit 100 points in the next month. Wow. All that is is a phone call.

That is amazing. 100 points. And again, please understand, listeners, this is not so that you can go out and buy more stuff with better credit. This is so that you're not going to be penalized with so many parts of your lives by having bad credit. And you will be if you do.

Again, it affects every part of your life. People are going to look at your credit score, what kind of risk you are. And I'm telling you, they're not going to lay down chips on you if your credit is low. And so this is great advice. Hospitals, doctors check your credit.

Hospitals and doctors are now before they offer or recommend procedures. So you need good credit just to make sure you can stay healthy and alive. And then the last thing I just want to make sure that people understand, if you've got a family member, particularly an elderly woman who's gone through dementia or whatever, and they haven't kept good books and so forth.

And it's a mess. Please, please, please don't just start writing checks from the estate. Yes. Okay, please don't do that. At least give it a fair shot of making a phone call going to Dr. Grayson's website build 850 credit.com. Now when they get there, if they're if they're not dealing with increasing their credit but they've got a family members passed away, do you just kind of, how do you have a.

So we do consultation, all the time. So please, especially if there's an estate situation before you pay anybody no matter who your executive is just have them come to us and filter the debt, so we do debt filtration, we don't even we charge you whatever we save you 10% of whatever we save you. So if you have $100,000 worth of debt you're about to pay, it'll cost you 10 G's for us to wipe that hundred G's away.

10% of whatever they're attacking the creditors are coming after. That's all you pay us and you pass after we've done it. So that way you guarantee that we're not. So there's no, there's, there's no risk to ask you to sit down with you guys. Give them a chance.

I mean, the answer is always no till you ask. Yeah, and, and you might as well what have you got to lose. Besides your credit and your money and your resources.

So, if those things are important to you, at least make a phone call at least go visit the website, build 850 credit.com and ask for a consultation if you're dealing with the state situation, whatever you know and obviously Dr. Grayson will have his staff prepared if you call in custody. Yes, probably not to do that. They want to help. Yeah, they work very hard they can't handle the stress please take it easy on them. So, listen, I really appreciate you coming on and share this and share your heart with us.

As things develop with this new laws come about if there's a new law passed this year, whatever. Would you be sure to let us know so we can. Oh, there's no question there's no question.

Dr. Michael Grayson I love that name because that's our son's name grace and PhD CEO of credit and debit Management Institute, and his website is build 850 credit.com. What a what a tremendous resource what a try. Thanks for the time today I really do appreciate you keep up the good work I appreciate what you do. People need your help, they need that good news. Again you too as well. This is Peter Rosenberger This is hope for the caregiver.

We'll be right back. This is john Butler, and I produce hope for the caregiver with Peter Rosenberger. Some of you know the remarkable story of peers wife Gracie, and recently Peter talked to Gracie about all the wonderful things that have emerged from her difficult journey. Take a listen, Gracie when you envision doing a prosthetic limb outreach, did you ever think that inmates would help you do that. Not in a million years, when you go to the facility, run by core civic, and you see the faces of these inmates that are working on prosthetic limbs that you have helped collect from all over the country that you put out the plea for, and they're disassembling you see all these legs like what you have your own prosthetic and arms and arms, when you see all this.

What does that do to you. Makes me cry, because I see the smiles on their faces, and I know I know what it is to be locked someplace where you can't get out without somebody else, allowing you to get out, of course, being in the hospital so much and so long. And so, um, these men are so glad that they get to be doing as one band said something good finally with my hands. Did you know before you became an amputee that parts of prosthetic limbs could be recycled.

No, I had no idea, you know, I thought a peg leg I thought of wooden legs I never thought of titanium and carbon legs and flex feet and see legs and all that I never thought about that. As you watch these inmates participate in something like this, knowing that they're helping other people now walk, they're providing the means for the supplies to get over there. What does that do to you just on a heart level. I wish I could explain to the world what I see in there, and I wish that I could be able to go and say, the, this guy right here, he needs to go to Africa with us. I never not feel that way out every time you know you always make me have to leave, I don't want to leave them. I feel like I'm at home with them. And I feel like that we have a common bond that I would have never expected that only God could put together. I know that you've had an experience with it. What do you think of the faith based programs that CoreCivic offers.

I think they're just absolutely awesome. And I think every prison out there should have faith based programs like this because the return rate of the men that are involved in this particular faith based program, and other ones like it but I know about that. This one is just an amazingly low rate compared to those who don't have them.

And I think that that says so much. That doesn't have anything to do with me. It just has something to do with God using somebody broken to help other broken people. If people want to donate a used prosthetic limbs, whether from a loved one who passed away, or, you know, somebody who outgrew them, you've donated some of your own for them to do.

How do they do that? Please go to standingwithhope.com slash recycle standingwithhope.com slash recycle. Thanks, Grace. One of our generous sponsors here at the truth network has come under fire fire from the enemy fire for standing up for family values, actually one of the biggest supporters of the movie unplanned that talked about the horrors of abortion. Yes, it's Mike Lindell. You've heard me talk about his pillows for a long, long time. And no doubt big business is responding to Mike Lindell and all this generosity for causes for the kingdom by trying to shut down his business. You can't buy his pillows at Kohl's anymore. You can't get them on Amazon or you can't get them at Costco.

They're attempting to close his business because he stood up for kingdom values. What a chance to respond, especially if you need a pillow. Oh, I've had mine now for years and years and years and still fluffs up as wonderful as ever. Queen size pillows are just $29.98. Be sure and use the promo code truth or call 1-800-944-5396. That's 1-800-944-5396. Use the promo code truth for values on any my pillow product to support truth.

Whisper: medium.en / 2023-12-27 09:15:54 / 2023-12-27 09:26:57 / 11