Looking for that perfect Christmas gift for the family? Why not a chicken? Stick a bow on top, put the chicken under the tree, and who knows, you may even have a couple eggs to fry up for breakfast Christmas morning.

Give the gift that keeps on cooking. A chicken. Okay, maybe it's not the perfect gift for your family, but it is the perfect gift for a poor family in Asia. A chicken can break the cycle of poverty for a poor family. Yes, a chicken.

A chicken's eggs provide food and nourishment for a family, and they can sell those eggs at the market for income. When you donate a chicken or any other animal through Gospel for Asia, 100% of what you give goes to the field. And the best gift of all, when Gospel for Asia gives a poor family an animal, it opens the door to the love of Jesus. So give the perfect gift for a family in Asia this Christmas. Give them a chicken.

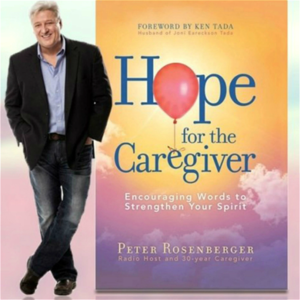

Call 866-WINASIA or to see chickens and other animals to donate, go to crittercampaign.org. Welcome back to Hope for the Caregiver. I am Peter Rosenberger. This is the nation's number one show for you as a family caregiver. We're thrilled to have you along with us. And by the way, if you're regularly listening to the podcast, you also know that we do a broadcast every Saturday live. We have lots and lots of callers and invite you to join that. You can go to hopeforthecaregiver.com to learn more about that, where you can listen, or you can just stream it along at afr.net every Saturday mornings at 8 a.m. Eastern. And John, we're on over 200 stations now. And then the podcast has really grown. So I want to thank you all for listening.

Thank you for being a part of this. We try to have really interesting interviews from people that are in the industry. We've got a great interview coming up here in a moment with Tommy Durfler to talk about investment, myths about investments, that a lot of people really kind of look at this thing all wrong. And Tommy's going to just give us some good insights. And I'm going to be interviewing Kathie Lee Gifford this week. We've got just lots of things, lots of things exciting going on. Christmas gifts for caregivers to give to themselves.

We started this last week. We're going to do it all the way through Christmas. And John, pick out another one. Well, it's oftentimes caregivers might get the quote short end of the stick on receiving gifts. You might be caring for somebody who is not capable of giving you a gift.

And, you know, and it is the season, you know, and it it can make you can really make or break a couple of a couple of bad days, you know. But this one, it doesn't sound like a gift, but it really, really is. And it's the first one.

It's the first one. Go see your doctor. Go see your doctor.

Go see your doctor. I'd also I'd also add, I always add and your dentist. Well, you your favorite character in Rudolph the Red-Nosed Reindeer, that that animated stop, stop. Oh, was it the little dentist?

What was it? I remember. But yeah, I know what you're talking about.

But it's and he took out all of the bumble's teeth. Yeah, but it's yeah, because 70 over 70 percent of caregivers do not see their own physician regularly. And this is a time bomb.

This is it's a time bomb waiting to happen. Right. And of course, shop around that, you know, don't shop for doctors like you think the shop around find a doctor that works well with you. And there are some really I had a doctor a while ago and she was just she was hilarious.

She was the funniest person. And it was just a delight to go see her. So, I mean, they can it can be you know, it doesn't have to be this clinical. Just yes, no, here, this is all about the health thing. And yes, it is. But it's, you know, it's getting out and getting professionalized on things.

And hopefully, you know, somebody with a little sense of humor. Well, and I subscribe to Teladoc. It's actually connected docs that I do. And I use that service. And you can message me if you want or send an email to us or whatever through Hope for the Caregiver. Just go out to the website and I'll give you information on that because I would I would have that service if I recommend that to everyone, because then it takes away a little bit of the weirdness of, you know, got to go find a doctor, go to the doctor's office.

Everybody's doing it now. And you can upload your chart. You can do all the kind of things and and then it doesn't interrupt your day so much. But it gives you access to a good primary care type of environment. Now, if you need a specialist or whatever, you're going to have to go to a different path.

And that's OK. But I think what drove this home for me was about this time last year. John, I was over at a clinic. It was at the over in Bozeman. And and I was there and I saw this woman in a wheelchair who was incredibly thin. She was elderly and very thin and looked very frail. And she was being pushed by a woman who identified herself at the receptionist desk as her daughter. And the daughter was morbidly obese.

I mean, really. I mean, every bit of 350 pounds, every bit of it. And I thought and I thought about, you know, heart, kidneys, blood pressure, knees, all the things that were going on with this daughter. And this very frail elderly woman was depending on this daughter who was in horrific health. You know, you can't be 350 pounds and five foot four or five and tell me you're in good health.

I mean, you just can't. And then you become a risk now for coronavirus and everything else because of morbid obesity is one of those things, those co-morbidities. And I thought, we've got to go.

We've got to keep encouraging caregivers to take that step. It's it really is important and imperative that you go see your own doctor. What a great Christmas gift to yourself. Yeah. And that's what I'm saying as a as a gift in the idea of it being a gift to oneself is that you might not see the immediate gift. Yeah, I could go see the doctor, get get things checked up. Maybe, you know, maybe it's a clean bill of health and you're like, oh, OK, well, that's good. But maybe you catch something that would have taken you down six months from now, you know, or just blood pressure. Yeah. Something as easy as that. And invest in a good blood pressure cuff to have at home, you know, and do that.

We've got two of them here. You know, those kinds of things are they're not very expensive, but they're very important. And and, you know, if you want to subscribe to that service with Connected Dots, again, message me. I'll show you how to do it. It's easy and it's very affordable. And you can you can have all of that at your fingertips. And why not?

You know, why wait for this? If you have high blood pressure, I promise you, it doesn't resolve itself. You're going to have to change something. You know, your cholesterol is high. And particularly a lot of caregivers are my age now. We're in our I'm in my under 60.

No, I'm 57. And so if I have high blood pressure and high cholesterol, that sets me on a path for some type of bad event in approximately 10 years. Yeah, it could be it could be really nasty. And that's the gift you're giving. You might not ever realize that you gave it to yourself. You avoided some tragedy, you know. And so, you know, these these are this is a small thing in the scope of things. And it may seem like a weird thing. But you know what? It's an important thing because your health is important.

What do we say on the show all the time? Healthy caregivers make better caregivers. And if you're not healthy, you're listening to the show today and you're looking down at your body and you're saying there is no way I can say this is healthy. I don't need you to be ashamed of it. And you certainly don't need you to be ashamed of it. Nobody's asking you to be ashamed. We're just asking you to take a step in the right direction.

A step in the right direction is two steps away from the wrong direction. Write that down, John. I've been saying that for years. But by the way, guess who came through with that dentist name for Rudolph? Oh, Ed came through with it. Hermey.

Hermey. And remember, who was who was the prospector? Oh, no, there was a there was. That's correct.

Ed is on top of it. These things were the soundtrack and the movie script of our life growing up. I mean, Rudolph every year. We had to watch Rudolph every year. And so.

But yeah, go see your doctor. It's a great Christmas gift to yourself. And healthy caregivers make better caregivers. All right. Do you have misconceptions about investment? Do you think things about investment?

What's the first thing that comes to your mind when you think I need to talk to some type of wealth management or investment group? What's the first thing that comes to your mind? You may be you may have some different thoughts after you talk to or listen to our next guest. He'll be back with us here in just a few moments. We're going to go to a break. Wait till you hear what he has to say.

You're going to love this. This is Peter Rosenberger. This is hope for the caregiver. Healthy caregivers being healthy financially, fiscally, physically, emotionally, spiritually, professionally.

And John, I'll even say mentally. We'll be right back. To put legs on our fellow amputees. And that's what we've been doing now since 2005 with Standing With Hope.

We work in the West African country of Ghana. And you can be a part of that through supplies, through supporting team members, through supporting the work that we're doing over there. You could designate a limb. There's all kinds of ways that you could be a part of giving the gift that keeps on walking at standingwithhope.com. Would you take a moment to go out to standingwithhope.com and see how you can give.

They go walking and leaping and praising God. You could be a part of that at standingwithhope.com. As a caregiver, think about all the legal documents you need. Power of attorney, a will, living wills, and so many more. Then think about such things as disputes about medical bills. What if, instead of shelling out hefty fees for a few days of legal help, you paid a monthly membership and got a law firm for life? Well, we're taking legal representation and making some revisions in the form of accessible, affordable, full-service coverage.

Finally, you can live life knowing you have a lawyer in your back pocket who, at the same time, isn't emptying it. It's called Legal Shield, and it's practical, affordable, and a must for the family caregiver. Visit caregiverlegal.com. That's caregiverlegal.com.

Isn't it about time someone started advocating for you? www.caregiverlegal.com, an independent associate. Welcome back to Hope for the Caregiver. This is the show for you as a family caregiver. And if you're not a caregiver, you're going to get something out of what we're talking about. But we're here for caregivers.

We're here exclusively for them. And that was my wife, Gracie, by the way. You can get that CD. It's a great Christmas gift. If you want to get it, go out to hopeforthecaregiver.com. Just click on the donate button. Whatever's on your heart to help do what we're doing. It's a tax-deductible gift to the ministry that sponsors this show. Hope for the Caregiver is the family caregiver outreach of Standing with Hope.

And you've heard Gracie's story about the prosthetic limb outreach, all that stuff. Whatever's on your heart to give, we'll send you a copy of that CD. And thank you very much for being a part of what we're doing. OK, John, do you still store your money in mayonnaise jars in the backyard? I have a delightful coffee can.

I do keep a small emergency fund in the house. Well, you know, one of the things I'm learning, and I'm not there yet, but I'm learning and I've got a good teacher. It's Tommy Durfler. And Tommy is on the phone with us today. He is from the Southwestern Fund Investment Group out of Brentwood, Tennessee, for caregivers particularly. We have to kind of think long term and we have to help. We have to have people who can do that with this objectively. And and a lot of caregivers get in their mind a myth or several myths about money. And we just don't have it. We just, you know, we I don't have enough money to go talk to an investment group. You know, I mean, you know, I'm not rich. There's only so many ways I can divide four bucks, you know. When did you get four bucks?

Somebody's overpaid. But anyway, so Tommy, you're with us here. I am. I hear you guys. How are you guys doing today?

We are well for us. Some of that may need to be certified by a professional, but we are so glad that you're here. This has been a topic that is that is kind of just stuck with me for almost as long as I've been doing the show, because we talk about the the whole part of a caregiver, the physical part and the physical part. And I just wanted you to talk about this today.

And let's talk. Let's just kick around a few ideas that maybe caregivers aren't thinking about or family members of caregivers aren't thinking about when it comes to wealth. So let's just start with the first myth that you have to be wealthy to talk to an investment guy.

That's a myth, isn't it? Yeah, it is. I think all of us that are in the business, we're here to help. And for somebody that doesn't know anything about the market or investing or how to handle managed money can be very, very overwhelming and a little bit scary. And so I think that's what we're here to do is to really help you and guide people into, hey, what are you trying to accomplish with the money that you're saving?

And then let's create a plan in order to accomplish that. And sometimes you just need a little guidance. You know, some people need a lot more help than others.

But to not have somebody to go to to help you with that, I think that's kind of maybe a mistake that people would make based on this myth that they think they have to have a lot of money or just money in general to really know what to do with it. So to give you a – yeah, go ahead, Peter. No, no, no. Go ahead.

Give me an example. Yeah. So this is kind of tying in my personal story here. So I think we've discussed this, but essentially I was born and raised in Raleigh, North Carolina. I had no idea I was going to do this for a living whatsoever. I became a wealth advisor. And so my passion growing up was playing the drums. And I did school, but school was a thing you did until about 2.30 or 3 o'clock when the bell rang.

Then you got to go home and do what you really wanted to do. And so growing up, my parents really never taught me anything about money. And the school system didn't really teach me anything about money. And so when I left and came to Nashville, Tennessee to become a musician, I really didn't know what to do with the little money that I had. And so that really intrigued me because as a musician here in town, money can be a dangerous thing because if you don't handle it properly, it just goes in and out of your hands very, very, very quickly. So with that, that's kind of what I thought, okay, I don't really know how this money thing works, but I need to go learn about this thing.

And that was probably 15 years ago. And so for me, I had a general interest in it, went back to school and majored in business finance and then also started learning about accounting and taxes and was one of those weird kids that found it really interesting. And so after that, I finally started learning and had this, I felt like God kind of redirected my passion. And so now in a situation where I can help other people, but I've also recognized that not everybody has the same passion that I do about financial management. And that's why I think it's really, really important to go talk to somebody.

If you really don't have the interest and the passion, you want to learn as much as you can, and you don't have to have the money to go learn about how to handle money. Well, yeah, if you've got a great team around you, you just need to pick a great team. That's the first step. And also being willing to ask for help. I mean, people aren't going to inflict help on you. That's called controlling. One of the things we tell people is I was just trying to help is the sunny side of controlling. And so people aren't going to do that to you and make you do it.

So asking for help is the first step. And what's another misconception people have, another myth about investment that people have? Yeah, I think the biggest thing I think is thinking that when you start investing, that you think that the market's going to go down and stay down. And that's the big fear a lot of people have is, wait a minute, if I put my money into investments, well, what happens if the stock market crashes?

That's what we hear all the time. What happens if the stock market crashes? Well, when you invest your money, the market has never gone down and stayed down.

We call that or I call that a temporary decline. And so you have to have a little bit of patience. And you have to understand how the market works a little bit. And if you do that, then you know that the market really does reward the patient investor. And so people think, okay, if I put my money into investments, it's going to crash.

Therefore, I'm doing the right thing by just holding it in the bank. And that just simply isn't true because the market has never gone down and stayed down. The problem is it just doesn't tell you what it's going to do today or tomorrow. And that's the hard part of that is it's kind of a fear of the unknown.

Nobody has the crystal ball. And so people have this fear and they're overcome by the fear. And they say, well, if I just don't get into it, then I'll never have to fear.

I don't have anything to worry about. And that just simply isn't true because you really want to diversify. You want to make sure you're managing the right risk level that you're comfortable with. And if you can do that responsibly, the market really does reward the patient investor. Well, and I think that caregivers are by definition, we're risk takers because we're doing something that's almost impossible to do, which is to care for an infirmed, impaired loved one for an undetermined period of time.

That in itself is risk. So I think that if we can help them understand that begets patients too, it requires a lot of patients. So we already have those ingrained in us, the ability to take a risk, the ability to be patient and to learn and adapt. And so why can't we apply those same character traits to the way we look at money? And I think that's what a good financial investment coach can do for people is help them transfer those.

You and I had a lengthy conversation for your blog and for your company about that very thing. And just learning to see it from a different angle and a good investment coach will help you do that. Yeah, and I love that too, Peter, because what it comes down to is having faith at the end of the day. As a caregiver, you have to have faith that things are going to work themselves out.

You don't have all the answers today. I think you have to have some kind of underlying faith that, hey, the future, as unknown as it is, is going to be okay. And that's the same thing with financial management and money investing. And in fact, earlier this year when COVID-19 really kind of showed its head, I did a webinar on this. And one of the things I mentioned in the webinar are pessimists are doomed.

They're doomed. And that's the way I think if you're in a situation where you're caregiving, I can't imagine you being a caregiver and just being completely pessimistic about your future. I mean, that to me would seem very, very difficult and almost way more on my mind than saying, hey, no matter what the situation is, you're going to have faith. Well, sadly, there are a lot, and we're trying to change that through this show to let people know that you can live a joyful life even while doing this, while you're looking at tough things. And I think that if we can help caregivers see that you can also be prosperous. I mean, there were people that made money and made really good money during the depression. You know, it just takes a little bit of ingenuity, a little bit of creativity and a lot of sweat equity.

But you're helping people like me. I mean, Gracie and I don't have all kinds of money, but you've kind of steadied the hand here a little bit and said, okay, here's what we're going to think long term and so forth. And the last thing I want to get into before we run out of time is I want to talk about, I want you to really spend a few moments talking about family members of caregivers like grandparents and so forth who now find themselves with a special needs grandchild. And how to be thinking ahead for some of the needs that those family members are going to have as a grandparent. Now, you want to do something for this grandchild or for this family to do things. And so talk a little bit about that too.

Yeah, I think that's the biggest concern. I hear that a lot is what happens if either the parent or the grandparent, they leave this world and then all of a sudden it's, okay, how are they going to financially make sure that the grandson or the son are taken care of? Are you talking about that way or are you talking about the other way? Both ways.

All of the above. If you've got grandparents and so forth, I mean, we're all going to need something. If you love somebody, you're going to be a caregiver.

If you live long enough, you're going to need one. But when you throw in a special needs family member, you know that ahead of time. And so if these grandparents out there that are my age and maybe a little bit older, and all of a sudden they find that their new grandchild has special needs and they've got some money that they need to set aside or something. They would like to do that. They'd like to think way down the road knowing that that child is going to need care for a lifetime.

There's Down syndrome, cerebral palsy, spina bifida, whatever. And so there are ways to do that. And that's where a good investment coach can come in and say, okay, here's some things you can do that are not going to be huge risk, but you're going to get better than just sticking it in the bank or John's case, a coffee jar. Yeah.

That's right. I mean, I think the biggest opportunity there is you have these trusts that are set up exactly for that reason, Peter. And that's the biggest concern a lot of the grandparents will have with the special needs child or grandchild is, hey, I want to make sure they're financially taken care of because obviously either the grandparents most likely will go first or the parents will leave first.

And so that's a huge concern. So you can set up a special needs trust. And what you do is with that trust, you can invest money to say, hey, we want to make sure that the child or the grandchild isn't just okay today. But we want a little bit of reassurance that they're going to be okay 5, 10, 15, 20, 30 years out when we're no longer here. And so that's really what you're trying to do. You're trying to set up a good special needs trust and you're trying to grow the money in a very prudent, responsible way because you know that it's not just about today's financial needs. It's about the financial needs that are, like I said, 5, 10, 15, 20 years down the road.

Right. And how much do you need to start off with? I mean, just ballpark, what's the lowest amount, for example, that you've ever had?

I don't know if you can say this on the air, but you probably can. What's the lowest amount that somebody's come to you with and said, hey, look, I've got this amount of money. This is all I have, but I want to start doing something.

What's the lowest amount you've ever dealt with? Peter, you can start with a $50 monthly draw. John, you're in baby.

We are all set. I need to go find a couple of shekels to rub together. I bet somebody is going to be asking me for a pay raise.

$50 a month. It does not take much. In fact, going back to the when do you start investing? The best thing you can do is start investing after you get your first paycheck. I mean, and it does not take much. A lot of employers out there have retirement plans through work.

You can do it that way. They make it really easy, really simple, but you don't have to have a lot of money just to start investing. It really doesn't take a whole lot, but the fact that you can start doing it will build a huge habit to really be able to help whatever your financial goals are. You know, that's what I wanted people to hear today in that I can tell you this from Tommy's group because I know them, I work with them, and they're not going to look down at you for any kind of money. They're going to be excited to help you because they see a big picture, they see an opportunity, and they have supreme confidence in their skill set and what they can do. And it really truly is about helping people grow beyond where they are at the moment.

Some people feel very trapped as a caregiver financially. I get it. Been there, done that. I mean, Gracie's that I can count so far is an $11 million medical nightmare that I can count. I can't even, it just keeps growing. And I've not lived paycheck to paycheck. I've lived minute to minute. And there have been times, man, when we were scavenging the sofa cushions trying to find enough change to do stuff.

It's a coffee can, man. We've been over this. And so if you get an investment counselor that in any way makes you feel like you are just not worthy of their time, walk out that door right away because there are people like Tommy who care about what they do and they want to help you get to a better place. Tommy, what's the best way if people wanted more information about your company and so forth, what's the best place they could go to and where can they go get more information?

Absolutely. www.LighthouseWealthGroup.com. That's the name of my wealth management team.

Go there, has a contact information on there. You can see a little bit about us and see who we are. And if you want to contact us, that gives you a phone number, email address and everything else. So again, www.LighthouseWealthGroup.com. Tommy Dorfler, Southwestern Investment Group. I really appreciate this, Tommy. This is an important thing. We're going to keep doing this more because caregivers need to know they have a trusted place they can go to get questions like this and start today becoming financially healthy.

And financially healthy caregivers make better caregivers. Merry Christmas, Tommy. Have you ever struggled to trust God when lousy things happen to you? I'm Gracie Rosenberger and in 1983 I experienced a horrific car accident leading to 80 surgeries and both legs amputated.

I questioned why God allowed something so brutal to happen to me, but over time my questions changed and I discovered courage to trust God. That understanding along with an appreciation for quality prosthetic limbs led me to establish Standing with Hope. For more than a dozen years, we've been working with the government of Ghana and West Africa, equipping and training local workers to build and maintain quality prosthetic limbs for their own people. On a regular basis, we purchase and ship equipment and supplies.

And with the help of inmates in a Tennessee prison, we also recycle parts from donated limbs. All of this is to point others to Christ, the source of my hope and strength. Please visit standingwithhope.com to learn more and participate in lifting others up. That's standingwithhope.com. I'm Gracie and I am standing with hope.

Whisper: medium.en / 2024-01-17 04:02:50 / 2024-01-17 04:14:51 / 12