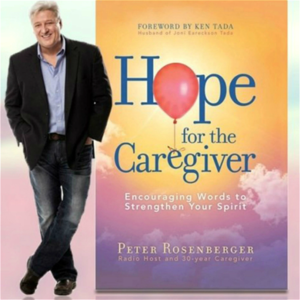

Welcome back to Hope for the Caregiver. This is Peter Rosenberger, and I'm glad that you're with us.

877-655-6755, hopeforthecaregiver.com. John, you recently had a friend of yours and his family go through what we're going to talk about here with my next guest, and I'm so glad that he called in. Do the setup and tell the story, and then I'm going to introduce our guest.

Gotcha. Well, this was a man who had a rough early part of his life and got into some really, really nasty trouble and was in prison for about 30 years or so. And this was what I was talking about earlier, that this is how I met him. Some dear, dear friends of mine were participating in like a mentorship program through their church for individuals who were getting out after long-term stays in prison. And he got out, and while he was in prison, he had purchased funeral expenses. He purchased funeral insurance. And he came out of prison pretty much needing a caregiver himself, but had gotten married while he was in prison to his longtime sweetheart. But she had really just profound medical issues and was not going to be able to really do anything to make money or anything like that.

They were, I won't say destitute, but definitely not close to it. But he died last year or year and a half ago, I think, and she didn't have to worry about anything. The whole thing was taken care of. I went to the service.

Which is no small fee. No, not at all. Absolutely. And so that's why, well, Al Kushner contacted me over the week and said, you know, would this be a topic that you guys would like to connect up on and so forth? And I thought, yeah, we've never covered this before.

And he wanted to talk about the value of burial insurance. And so, Al, is it Kushner or Kushner? Kushner.

Kushner. I'm so sorry. I should have known that. All this hits a little bit. Al, great to have you here with us.

And you're on the phone with John and me, and we're thrilled to talk about this. But John's story of his friend, that's one that you've heard many times, and then you've heard the flip side, the horror stories of this too, haven't you? Yeah, it's a challenge, I think, when people think that, you know, just by applying for insurance, it's automatic, and it's not necessarily the case. And a lot of times, there'd be situations where a person could have a medical condition, a pre-existing condition, which may prevent them from getting benefits for two or three years, depending on the company.

And a lot of times, sometimes they can be declined because, you know, they didn't realize, you know, that health ailment is not in favor with the company that they are applying to. So that is the challenge a lot of people face when looking at coverage. And premiums can vary, you know, ranging as much as 40 to 50% higher, you know, if you don't really shop around.

And that's really what my book talks about, The Savvy Guide to Buying Burial Insurance. What do people need to look for with a policy like that? What are some of the things that you would caution them on and some common mistakes that people make? And then some positive things that they can look for and say, okay, this is something we need to make sure this is included.

What are some tips like that that you would offer? Well, the important thing is to look for an agent who is independent, because they usually will have your best interest. So they should have at least 15 to 20 companies that they represent. And they'll be able to pretty much shop around for a company based on your health condition, because most of the people who are applying for this coverage have some type of ailment they have or medication that they're taking and the insurance companies are aware of this. So, and that's really something that you need to really look at, you know, you, you see a lot of times on TV ads and such that really talk about, you know, being inexpensive, but a lot of times they don't talk about the fine print, which is really, you know, if you have an underlying medical condition, or things that may limit you in terms of getting benefit based on that health condition.

So it's really important to speak to someone who's independent that could give you, you know, the best value for the dollar. Or, you know, that they benefit from maybe not selling the, the best, you know, the best thing for for you. And yeah, you were you were saying, you know, a lot of times when people are shopping around for this. It's for a reason. So the insurance companies are aware of that.

So that makes sense, you know. What is the average funeral cost? Well, it varies depending on where you're at. So you guys are located at where, what state? Well, John's in Tennessee.

John's in Nashville. I'm in Montana. And out here, it's more like you go for a walk in the woods kind of thing. I mean, you know, you may come back, you may, you fill your, your, your shorts with chum and go into the ocean in some places. And out here, you just grab a couple of rolls of ground beef and just walk into the woods.

No, I kid. But so we're in Montana. So it's, you know, you're right. It's state by state. But as a, as a general rule, like, where are you, Al?

I'm in Florida, in Florida, South Florida. So it varies. There's like a website you can actually go to called a parting.com.

P a r t i n g.com. And that actually will give you a price breakdown what the funeral costs average in based on your zip code and where you're located. So because it does vary. And it depends on you know what features you're looking for, you know, in in a field because there's a lot of, you know, things added to that, you know, whether it's flowers arrangements, if you wanted to caskets, all these things are need to be looked at prior to that. And that's something that you can kind of look at on the website and to get more of an exact figure, but I would say it ranges anywhere from 7500 to as much as 15,000, you know, on the average, maybe more depending on how elaborate you want, you know, And that's quite a sticker shock when you're going through the immediate grieving process as well. You know that you're you're going to be dealing with all the drama of the loss of a loved one and then all of a sudden you're faced with this kind of cost. That could be a little bit overwhelming and daunting, I would imagine. And, and I think this is this is why I wanted to have you on today because I think people overlook this and these policies don't have to be hyper expensive, particularly if you start now instead of waiting till, you know, the doctor just gave you three months to live. Yeah, yeah, yeah. We all know this is coming at some point, but you don't want to do it. Well, you know, it's, it's, yeah, that would be bad.

Well, yeah, that's what you're looking at. So you're really kind of, you know, obviously, the younger you are, the less cost it is, of course, and the healthier you are, the better to your advantage. But again, you know, don't get dissuaded if you had applied for coverage and were declined. A lot of times there are companies out there that will accept you.

I mean, I've had incidences where people had COPD, which is a condition that most companies won't even touch, but I do have some carriers that will take them on, you know, and there's a lot of people out there. You know, and then and approve them literally the same day. So a lot of times people realize that they can actually be covered literally within 30 minutes, you know, so it's not a long drawn out process. It's really quite easy and you can do it online. You know, it's very simple, you know, so do you have to have a physical. No, what's what's great about no physical is required, you know, just answer a couple of health questions and even situations, you know, we have, you know, policies that will issue guaranteed issue.

So which does it require? So no blood work, not like it's not like a life insurance policy where you have to have somebody come and do blood work and all that kind of stuff. It's not quite the same. I mean, it's a policy that's life insurance, but specifically, it's not where you require blood. I mean, nowadays, you know, a lot of people don't want to have someone come into the home or go to a place because of COVID and such so they want convenience. And over here, you know, you can do it literally online and, you know, and just talk, you know, usually it takes maybe 20 minutes of conversations with, you know, me and the insurance underwriter. And most of the time we can get people approved within 30 minutes or less. So it really is convenient nowadays.

It's just really, you know, a no brainer if you think about it. So you don't have to worry about, you know, a lot of the things. It's just a matter of, you know, answering some questions and really just have the ability to see what payment is that works best for you. You know, payment plans could be, you know, is affordable. It's not really expensive depending on your age, of course.

So wait until you're like 85 or 90 years old, of course, you know, that would be more expensive. Tell me about your book. Tell me about your book. You know, this is not certainly a subject you hear a lot of people writing about, but it's certainly one that everybody's going to need to deal with. Well, yeah, well, it's just a resource that's available and it's online and on Amazon and other fine retailers.

And it really just gives you kind of like, you know, the details on what the process is. It compares options in terms of you want to get insurance for yourself or maybe you want to get for your parents. You know, a lot of times people are buying coverages so they can take care of the expenses of mom and dad. A lot of times it's something that, you know, a lot of people don't want to talk about, but it really is something that you have to address because someone's going to have to pay for that. And a lot of people think they can rely on Social Security pay, but most of the time the most they'll pay is $255. So it's really very limiting in what you'll actually receive.

And that's what people think that's not the case at all. So a lot of my clients, you know, they're buying it for their parents and all the buying for themselves individually, you know, and what's great about it is that the premiums never increase. They stay the same and the policy is guaranteed renewable and it pays immediately.

You know, it's just something that just gives you peace of mind. And that's something that you don't really find in a lot of insurance policy, particularly a lot of people have term insurance and those policies usually expire at age 70 or 75. And at that point, you know, if you're at that age, you're going to have to need something to cover, you know, those final expenses. So this is something that is permanent and, you know, take it up to age 100. So that's really what people want to have is just the policy just designated for final expense because that's what you're looking at. And nowadays we're looking at the average cost of funerals, let's say if it's 15,000 in 20 years from now, it could be double that amount. So we've got to anticipate for the future and that's really what people need to be aware of. So the book really goes into detail about it and educates and informs and something that, you know, it helps you make a choice based on information you're provided not from, you know, an agent's brochure.

You know, this is something that you can decide. And most times we can get people covered without having to go to the home. It just makes it real easy, you know, over the phone. That's really what's great about it. So, yeah. Yeah, yeah.

It's definitely a good thing to have. And we talked about this on the show a couple of weeks ago, but, you know, one of the greatest things you can do for the people who are going to be in that situation where they're, you know, they're already they're mourning you. And having to deal with all of this.

And then you get the sticker shock like we were talking about is to just, you know, for the people that are a great gift for the people that are left behind after you to just, you know, take that off of them and make sure that they don't have to have to deal with all of the mess. It's just all planned out and taken care of already. It's a real long way. Yeah, yeah. Well, the book is called The Savvy Guide to Burial Insurance, Al Kushner. Al, I got two questions for you real quick.

This may seem stupid, like a stupid question, but, you know, consider the source. Yeah. But do they, when you do these policies, because these things, everything happens pretty fast, you know, when there's a death. Everything gets moved into overtime. Do they work with the funeral home directly or do they just kind of check to the person and the person is responsible just dealing with the funeral home or some combination of both? Well, it's the beneficiary as you designate. So if you have, you know, a child, for example, who's an adult and they would receive the benefits or whoever you want to designate. Some people even leave money to charity, for example, or a portion of it, proceeds, you know. So it's something that people want to give, let's say, to the church or whatever, or they'll have it for someone else, but enough to cover the funeral expense and maybe a little bit extra, you know, for others. Okay, so it goes to the individual. What about, do funeral homes, do they have a setup like, you know, physicians do with a preferred provider type of thing where if you work within some kind of network, because I know a lot of funeral homes are networked now.

Is that even on the radar or is that way out in left field? Well, I mean, it doesn't really apply because, again, this is something where the insurance company will provide a check to the beneficiary. Most of the time it's not the funeral home that's the beneficiary.

It's the individual handling the expenses that have occurred for coming in. But they don't have like funeral homes and like if I bought a policy from XYZ company, would they have a list of funeral homes they would recommend, for example, in my area if I don't know who to call, that kind of stuff. And because I go to one of those, maybe because I'm a, you know, a beneficiary of such and such policy, then I may get some kind of a little bit discount or something in a network. I mean, I know it's a little bit out there, but I'm always looking for a good discount.

How do we do it? Volume. Yeah, well, the key thing is, you know, you can go in my book, there's a resource on where to shop around for funeral homes and such, and you could see pricing and what have you. So it's always good to look at and compare and look at the reviews also. That's also important.

A lot of times you can see which homes may be better suited for you and which ones may stay away from. So, yeah, it's always good to have. The Savvy Guide to Buying Burial Insurance, Al Kushner. And right now, if you go out there on Amazon and Kindle, they're offered to for free on Kindle only. There you go. Just the digital version. So it's a great buy.

And Al still gets royalties for that because Amazon, that's coming out of their nickel. So you're still helping out there. But Al Kushner, The Savvy Guide to Burial Insurance, an important topic for us as caregivers to talk about.

There's nothing like planning and avoiding the drama that can happen. And so, Al, thank you for being a part of the show today. We'll have you back on. I appreciate you calling in. You're welcome. This is Hope for the Caregiver. Have a good day.

Yes, sir. This is Hope for the Caregiver. This is Peter Rosenberger.

Don't go away. Healthy caregivers make better caregivers. We're still on a mission to help strengthen family caregivers.

Hey, this is Peter Rosenberger. In my three and a half decades as a caregiver, I have spent my share of nights in a hospital, sleeping in waiting rooms, on fold out cots, chairs, even the floor. Sometimes on sofas and a few times in the doghouse. But let's don't talk about that. As caregivers, we have to sleep at uncomfortable places.

But we don't have to be miserable. We use pillows from MyPillow.com. These things are great. They have a patented interlocking feel that adjusts to your individual sleep needs and for caregivers trying to sleep in all the different places we have to sleep, believe me, our needs get ramped up significantly. Think about how clean your pillows are. In the COVID world, we're all fanatical about clean. Can you wash your pillows with MyPillows from MyPillow.com? We throw them in the washer and dryer.

We do it all the time. 10 year warranty, guaranteed not to go flat, 60 day money back guarantee, made in the USA. As a caregiver, you need rest. So start by going to MyPillow.com, typing the promo code CAREGIVER. You get 50% off the four pack, which includes two premium pillows and two go anywhere pillows. You'll also receive a discount on anything else on the website when using your promo code CAREGIVER. That's MyPillow.com promo code CAREGIVER.

Whisper: medium.en / 2023-12-16 09:55:30 / 2023-12-16 10:03:05 / 8