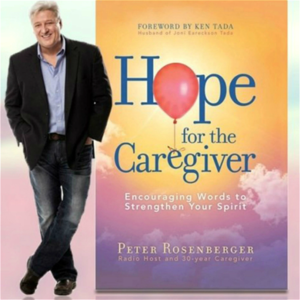

Welcome to Hope for the Caregiver here on American Family Radio.

This is Peter Rosenberger. This is the program for you as a family caregiver. More than 65 million Americans right now are serving as a family caregiver, providing more than $500 billion dollars, that's billion with a B, in unpaid care every year. $500 billion.

Now to give you some perspective on that, that has been historically our annual trade deficit with China, which came to light during Trump's run for office back in 2015, of how we were at such a disparity with China over trade, and they were making basically $500 billion dollars a year off of us, that we were just giving away. Well, that's how much family caregivers provide every year in unpaid labor. Think about what that means to our society, to have that many people providing that much care.

How much are you doing? If you put a dollar amount to what you do? I mean, have you gone out to try to price what it would be to replace you? I mean, think about it. Think about how many hours you put in.

You're on call all the time. Think about what the going hourly wage is for this. And that's the reality of our country right now with family caregivers. Now, I don't know that that's going to change. I just thought it was a little bit interesting to see those numbers, how they kind of work out in real time of what those numbers mean.

$500 billion dollars. This program is about strengthening the family caregiver. Part of that is learning how big the problem is for us as individuals, for us as a collective demographic, for our society. What's coming down the pike?

What does this look like? And there are a lot of things that people are throwing into this hopper based upon those numbers that I just gave you, based upon the population that is doing this. And they're seeing a disparity on how much is being spent, physical and fiscal resources on people with disabilities, the elderly and so forth. And I don't know if you've seen this or not, but there are quite a few articles written in that vein. Commentaries by people who advocate for spending less on the aging, less on the disabled. You saw the thing in Canada recently in the news that she was a paraplegic athlete and she was looking for a wheelchair lift hoist at home and they gave her a do it yourself suicide kit. That's what they offered her. Don't take my word for it.

Go look it up. That's not going to be the last time we see something like this. It is much easier for a society that doesn't value life to go ahead and end life that is very cost prohibitive. And cost prohibitive could be dollars or it could be people that just don't want to do this anymore. They don't want to take care of somebody anymore and it's cramping their lifestyle. And you think, well, Peter, that could never happen.

Well, yeah, it is happening. And you're seeing it more and more. Dark thoughts in her caregiver's head when they are pressed on all sides.

And I've written many commentaries about this. I've seen this with families who reach their breaking point and I've seen this with couples who have one person is taking care of another one. There's a bad diagnosis for the caregiver. They don't know what to do. So they opt for murder suicide. Go look it up.

Don't take my word for it. Just look it up and you'll see that this is happening around us. Well, why is this happening? Yes, it's stressful. Yes, it's hard.

But why is it happening? Well, do we have a society that promotes life? I mean, would you say that the United States of America is a life affirming society? If you say that, what evidence do you back that claim upon?

Because I'm seeing an increasing shift towards devaluing life. Now, this is not new. Francis Schaeffer and C. Everett Koop covered this back in the seventies. C. Everett Koop used to be the Surgeon General of the country. And he and Francis Schaeffer did a whole series of, you know, whatever happened to the human race. But when Roe versus Wade came down and abortion became legal in this country, it set in motion a series of philosophical approaches to the way we view life in this country and worldwide. And it certainly wasn't lining up with a biblical worldview.

When you can kill a baby in the womb, what's keeping you from killing an aging person with Alzheimer's? Or as Canada just did, a paraplegic offered them a home suicide kit. It's not just that they offered them, they had them available.

It was readily at their fingertips. It's not something they had to go, let me see if I got something in the back room kind of stuff that can help you. No, no.

Hey, we got one of these. You know, that's the kind of thing that's happening. If you don't believe me, go Google it.

Go look it up. And you're going to see more and more of this because the federal government is $31 trillion in debt. The cost of caring for people is astronomical. Again, 65 million caregivers roughly in this country providing $500 billion in unpaid care every year, every year. So how do you prepare for this?

How do we deal with this as caregivers? How much does it cost you to do this? How much do you have to pay somebody to do this? How much are you worth when you do it? If you had to be replaced, how would you do all these things?

What's the math? And these are important questions that we have to ask ourselves and deal with. But the first question we have to deal with is life, a biblical worldview of this. What does God have to say about this? What does God have to say about life?

Why are we throwing these vast resources at individuals who may not make it or as society may look at them and say they're not contributing to society? Are we going to take society's worldview? Are we going to take God's worldview?

Actually, I don't even want a worldview. I want a biblical view. What does Scripture say? And we can quote a lot of these Scriptures that before – David said, when I was conceived in the womb, you knew me.

I'm fearfully and wonderfully made. So does that mean that people with birth defects, congenital things, are not fearfully and wonderfully made? And I would suggest to you that Scripture teaches that every life is fearfully and wonderfully made, and life is to be valued. But when life becomes cheap as our society has made it, it becomes a nuisance to bring a child into the world. I'll never forget Obama stating this, that he didn't want his girls to be punished if they made a mistake. And the punishment would be to have a child. When a child out of wedlock is considered punishment, or a child, an unintended child, how about that, is considered punishment by a sitting president of the United States, what does that tell you about the way a lot of people in this country look at life? And if we're going to devalue life in the womb, or as you just recently saw, this debate about having to care for children that are born alive in an abortion that wasn't successful.

And you've got an entire political party that's outraged about that. How many exits must we go by on that particular interstate before we start devaluing life after the womb, institutionally, as a country? Okay, we're done. We're going to cut off the care for this type of thing.

Well, I've got news for you. It's already happening, and it's going to get worse. We need to prepare for it. We need to prepare ourselves spiritually, physically, and financially. We're going to talk a little bit more about things like that today, including bringing on an expert who can help us better finish well in life, to have those resources at the end of our lives, and the end of our loved one's life. So we're going to cover a lot of ground today, but we always go back to scripture.

That's our authority, every time. This is Peter Rosenberg, and this is Hope for the Caregiver. Hopeforthecaregiver.com. Don't go away.

We'll be right back. Welcome back to Hope for the Caregiver, here on American Family Radio. This is Peter Rosenberg. This is the program for you as a family caregiver, and he does know the plans that he has for you. And that is my wife, Gracie, from her CD, Resilient.

And she is indeed resilient. We're talking about finances today. We're talking about the cost of care, both physically, spiritually, emotionally, and fiscally.

You see what it cost our country? We talked about that in the last block, and I have a special guest on today. It is Hans Scheil. He is the host of the Finishing Well radio show and podcast, and also the author of the book, The Complete Cardinal Guide.

And he's got over 40 years of experience helping individuals plan for or near retirement. Hans, thank you so much for being a part of this program today, and welcome to the show. Yeah, thanks for having me. I want to go right to the Bible, because just doing this show for five years, and being with my friend and partner and really biblical teacher, Robbie Dilmore, he has me. I'm reading a chapter of the Bible every day, every morning, and that's how I start my day, and sometimes more. And I just came across this verse in Luke, and I don't think it's by chance.

And I went to Luke back around Christmas, just because I wanted to read the Christmas story, when all the commercialism was going on. And then, you know, it just led me to this point where I'm reading, invite the poor, the crippled, the lame, the blind, and you will be blessed, because they cannot repay you. For you will be repaid at the resurrection of the just. And so I think what Jesus is telling us here is that we're to care for the poor, the crippled, the lame, the blind, and we're supposed to invite them to our feast and give things to them, do things for them. And where this speaks real specially to me is, I have all kinds of people calling me from all over the country, and I stop and I take the time to help them. And, I mean, all kinds of people, people that are rich, people that are middle-wealth, and I have a lot of people that many would describe as poor, and it's usually the people that are in a bit of a hard way financially that they can use my help the most. And so as soon as we get somebody that comes to us that is in need, immediately the antennas go up and we work extra hard to give them something that they can use. And this just spoke to me because I'm always struggling with this because I do run a business here, but we work extra hard for these people and we don't charge them.

And I'm talking about people that maybe have $70,000 in their IRA and that's all the money they have in the world, and they've just let it sit there and now they're facing minimum distributions. I might even be talking to the daughter, and the daughter who's looking after the mother, and they need to take some money out of this thing and they really need some help doing it, and I'm there to help. And this verse just gave me some real strength coming straight from God that these are exactly who I'm supposed to be helping. Well, and Luke 14 is where that is, and that is a fabulous scripture that gives the mandate of who we are as believers to go out to the highways and the byways and to reach these folks.

And Jesus said very clearly, sick, naked, hungry, thirsty, prison. These are things he's looking for is to help others do this. And this audience is filled with caregivers who are putting themselves between a chronically impaired loved one and even worse, disaster. And the financial toll it takes on them is substantial. I know I've been doing it now 37 years. And I look at people with $70,000 in their IRA with envy. I've had a long journey with Gracie.

All my money is in Gracie. She has quite a journey here. So I wanted you to kind of share some things about what are some common mistakes that people make in this journey that you see, and then let's talk about ways that you help kind of redirect them out of that. Well, the first one that I see is the spouse as you are taking care of the loved one, the other spouse, or their wife or husband, and letting themselves get so run down that they end up sick themselves. And I'm sure that that's not what you brought me on, is to talk about that. I'm sure during your discussions you give people a lot of help and advice on that about taking care of themselves. But I would just put that from my perspective as the biggest mistake that people make. And sometimes they make it just because they don't have any other choice.

So I'm going to take them off the hook a little bit here. But when we get it to financially, what is the biggest mistake that caregivers make with their money is, number one, is avoiding and not the purchase of long-term care insurance themselves. I mean, that should be, if they don't have it for the person who is ill, and then they've just discovered this, and now they're in the caregiver position, they absolutely need to buy some long-term care insurance or something, some type of solution, and do some planning.

So when they end up sick, they're not going to have a healthy spouse to take care of. So I would put that down as number two. How do you distinguish between what's a good long-term care policy to get? What are some warning flags that we should, some red flags that we should be aware of when we go out to purchase these things?

What are some guidelines that we need to keep in mind? Well, what I say, there's four different categories of long-term care insurance or long-term care planning. And why don't I go over those first? I mean, you've got short-term care. You've got traditional long-term care insurance, which is, I think you were referring to, and I was referring to earlier.

That's number two. Number three is going to be this hybrid life long-term care insurance, where there's the mixing of a life insurance policy and a long-term care policy in such a way that if you don't use it for long-term care, it pays off to your heirs after you die in terms of a life insurance benefit. And the fourth category is self-insurance. And you say, well, that doesn't sound like insurance. Well, self-insurance is where about 85% of the country is right now. And they're there by default.

Meaning they just said, I'm not going to do that. I'll just take care of that myself. I'll just pay for it if it happens. And so they're on self-insurance and they're there by default. And what I'm speaking of is self-insurance by design. And that's really what I end up doing with a lot of people who can't qualify for the other kinds of insurance because of their health. Then we're going to sit down and put together a plan. Well, what are we actually going to do if you need care? I mean, what's the plan? And that's what self-insurance by design is.

So there's four kinds. And I want to answer your question of what should people be on the lookout for? Well, the first thing I'm looking out for is, does the person see the need? Because I think you asked the question in the vein, they already see the need.

They know they have the need. And I'm going to get to a couple other things here. And I think we're getting a little ahead of ourselves assuming people are actually going out and looking for long-term care policies. And I don't really think that's the case.

Well, I think you're right. I think you've got to figure out, you've got to come to that point where you realize this is not going to end anytime soon and it's probably not going to end in a way that I would like it to. So how do I prepare for this and be a good steward of me and our resources to the best of our abilities? And that's the first question we as caregivers have to ask, because when, particularly when you have families with special needs children, because the moment you get that diagnosis, that child is going, may outlive you. I mean, you have family members with children with autism.

I'm seeing a lot of this. Well, the child is not terminal. And I've got a very close friend of mine whose son now is in his forties and he has Down syndrome.

Well, my friend is in his seventies and it used to be that Down syndrome children didn't live that long. Well, now they're living a lot longer and now he's thinking that this child is going to outlive him. So these are hard moments of realization that caregivers are coming to.

They're the big, big obstacles in their path. And, and so that, that reckoning of, okay, we're going to have to make a decision here is the first step. You're right. And people aren't going out looking, they're kind of pushing this off way out into the future, but it's, it, it's, it needs to be right around the kitchen table today. That's what I hear you say.

Yeah. So that's what I'm going to look for is, you know, is just like the recognition of the problem and the interest in solving it. And we're going to spend some time and there first and the next place, or while I'm doing that, we've got to look at the resources. So when you're thinking about going out and looking for a long-term care policy, maybe I get them to that, how are you going to pay for this?

And that's where we really get into the three, four categories that I talked about. He has, you know, cause you can buy traditional long-term care insurance and you can just pay for that by the month or by the year. And it's not cheap. We can talk about some general premiums in a second, but it, you know, it's the place that people that don't have resources or money in the bank or money in an IRA, money in a 401k, in CDs, in something that they can put toward this problem, then we're going to look at traditional long-term care insurance. If people do have resources and they've got assets, well, we can't take all of them and throw them at this problem, but we can, that's, what's going to happen if they actually get sick and need care, all their assets are going to get thrown at it, but perhaps we can take a piece of them and buy one of these hybrid life long-term care policies, either IRA money or just regular money that you've already paid taxes on. And we can pay for this stuff with one premium.

So, or a combination of the two. I have some people that will buy half their policy with a single premium, and then they'll buy a traditional long-term care policy to go along with it. So they pay as you go and pay all up front.

I mean, there's endless combinations. And I think that the short-term care is something that really doesn't get talked about. It's available in 39 States. I mean, there's a few States like California, New York, Florida, that don't allow insurance companies to sell these short-term care policies, but 39 States have it. And it's simply a policy that'll pay for a year of care at home.

And it'll pay for a year of care in a facility. Well, hold that thought for just a second. We've got to go to a break. We're talking with Hans Scheil, and he is the host of The Finishing Well broadcast and podcast. We're talking about taking care of ourselves, being good stewards of our resources and planning for the future for finishing well.

This is Peter Rosenberger. This is Hope of the Caregiver. We'll be right back. We're so reactive that sometimes we think, well, we'll wait when that happens. But with finances and with the cost of everything going up the way it is and the intensity of it, we can't afford to wait until that happens to come up with a plan.

Then we're going to end up just really in a pickle. And Hans has spent a lifetime helping people avoid that and redirecting out of that. So we're talking about the first thing you talk about is long-term care insurance, short-term care policies, if they're available in your state, some types of life insurance, some policies that you can have to shore up this very vulnerable area of our life.

So Hans, it's great to have you here. Continue on with what you're talking about as we start to look. We don't want to get ourselves in a situation where we're insurance poor, but at the same time, we don't want to be destitute when the unthinkable happens.

And with caregivers, we know the unthinkable is right around the horizon here, very soon approaching to us. Well, I'm going to just mention when you're starting to shop for this stuff or you're looking for it, I'm going to recommend that you shop for the person to help you with it more than you do the shop for the policy or the company behind it. Because 30 years ago, you would shop policies. You'd invite the person from three or four different companies out, three or four different people, and they would each give you a quote and talk about their policy. But today's day and time, most people that sell this stuff represent just about everybody anyhow, okay? And they've got all these options I'm speaking about.

And so you really want to pick a person. I mean, you can look up the CLTC, Certified in Long-Term Care Insurance. It's a national association of financial advisors that specialize and they've had specialized training in it. So that would be one place that you could look. But you really want to interview to find the right person that knows like what I do about the different types that are available. And we haven't even really talked about health yet because we start talking about short-term care, and I'm going to talk about that.

And that's a good option for people. But what pushes a lot of people there is the person who are writing the policy on their health conditions. So like I have a lady sitting out in my lobby that is a client, and she has MS. And she's doing pretty well. She's in her 60s.

But with MS, it's unpredictable when that's going to hit you and how hard it's going to hit you. But she's certainly, for either traditional long-term care or one of the hybrid policies, she's not insurable. And she may well be not insurable for short-term care. And say, well, why are we talking about her? Well, her health has her in an uninsurable place.

Now, there's a whole lot of people. We have people get declined for hybrid long-term care. They're ready to put up a whole bunch of single premium.

And we write a couple, and then one of them just gets turned down because of something like osteoporosis, something like that. And so we're able to go back in and put a short-term care policy on that person. And I'm thinking for a lot of you caregivers out there, you may have health conditions yourself that prevent you from buying traditional long-term care. But I'll bet there's a chance you can get this short-term care.

And it's pretty simple. It's going to provide one year in a facility. It's up to like $400 a day you can buy.

Most people buy like $200 a day or $6,000 a month. And it'll pay a whole 360 days. And then you're done.

Okay. And then for home health care, it pays $1,200 a week as an indemnity benefit. And then you can pick your caregivers. And there's a small floor on there that you got to have three visits in a week from a home health care agency to qualify for the whole $1,200. But then they just send you the check, and they'll pay for 52 weeks of care.

I mean, it's over $60,000 that they'll pay, and then you're done. So it certainly doesn't provide the several years care that a traditional care policy does. But it doesn't cost as much, and it's easier from a health standpoint to qualify for. That make sense? It does make sense.

It makes a lot of sense. And when you start thinking about how much the hourly rate is for caregivers to come into your home, that $1,200 gets eaten up pretty quick per week. And so that seems to be a very attractive path for a lot of caregivers right now that short term.

If you're able to squeeze that out, in fact, that's something I think I may look at for myself. I've got several things going on, but I live with a very volatile situation. I often tell myself and my fellow caregivers, sometimes we caregivers are one sprained ankle away from this thing turning into a Greek tragedy.

Because what happens when we go down? I mean, a lot of times when people start needing home health care, they don't need it 12 hours a day or 24 hours a day. I mean, there's a lot of people that, you know, four to six hours, two to four to six hours, several days a week can get them along for a while. And the whole idea behind short term care is I use this with a lot of people that have picked that self-insurance route. And I'm saying, okay, so you've decided not to buy this insurance, and just take this risk on yourself. And if you've ever sat down and tried to talk an 85-year-old man or 85-year-old woman that has money into spending some of it on care, you probably have tried to do that, Peter, and you know what I'm talking about, is it's not an easy sale. And I tell people that at 60 years old, that it would be good for you to buy this policy, and that way your family is going to be able to call somebody up and get them in there, and they're going to have a year to figure out what they're going to do next and how they're going to spend your money. Well, and I've got some friends of mine right now out here who, his aging mother, and it's costing quite a bit of money for her. And then they're thinking, okay, what's going to be left over for us?

Because they're both in their 50s. And so they're in that spot. So I'm going to be making sure they hear this conversation with you today, Hans, because I think this is what we need is that clear direction. Okay, here's some options. As I've said for years, don't let your eschatologist be your financial planner, because praying for the rapture is not a financial plan.

And you'd be amazed how many people do that, Hans. And so I'm trying to redirect a little bit and say, okay, let's be a little bit better stewards. How about that?

So talk about, go to the next one here. Okay, you're shopping for the person, not necessarily the company or that particular policy. You're looking for a financial planner. What are some things you want besides going out to that place that you mentioned, the national organization, so forth? If you just Google CLTC, they'll come up and it's a certification for long-term care. And they just put your zip code in there and they'll just give you a list of people who have been through a training and they hold themselves out as people experience. I mean, don't just go with the first one, but that'd give you a good place to start of people that are actually in this business like me. What kind of question would you ask if I was interviewing a financial planner like this and I got their name from this organization and I told them, I said, I'm looking to do this. What kind of question would you ask to kind of get a feel for who they are and what they can bring to the table? Well, I think to go into my first questions that I'm going to ask the consumer calling me is maybe why do I need this? Tell me why I need long-term care.

I mean, if you're the consumer calling in because you're just setting them up to explain to you maybe what you already know, but you can just play devil's advocate for a second. So I'd start there and then I'd be looking at what are the questions that they're asking you? I mean, it's just that they need to find out about your resources and you need to be ready to share that with them is how much you got bringing in by the month, whether there's discretionary money, whether you have money in your IRA or 401k, whether you've got other money or assets, which are certainly at risk if you're needing care in the future, but you're wanting them to ask you about that, or you need to be prepared to share that because that's the first place where how are you going to pay for this thing? And then we need to get into, which I think you've been on since the beginning, is when we start vetting the particular policies, we need to know how long is the elimination period, which is like a deductible. I mean, if I get sick and need care, how long am I going to have to wait before I can collect something out of this policy?

How much is the daily amount? Does it pay equally for home health care as well as assisted living as well as a nursing home? How many years is care covered or what's the overall maximum on the policy? Is there inflation? Because it's fine to talk about it in 2023. What's this stuff going to cost in 2040? And is this policy that you recommend going to be sufficient to cover it then?

Have you thought about that? What are the health qualifications of the various policies? And do you have a company and do you have, I mean, if somebody asked me this of me, do I have several companies and several policies within those companies that will write somebody with health conditions? And you know, the answer to that with us is yes. And you would want whoever you're doing business with to have a lot of options. Like the lady that has MS, we have something for her.

You know, it's not simple, but we've got a solution for her. If I'm interviewing this individual to see what, if they can meet my needs, what are some red flags that maybe I need to move to the next individual when I hear them saying certain things? What would you say? Okay. Because a lot of people don't know anything.

They've never even talked to a financial planner. So how do you know if you've got one that's going to be somebody you can rely on? What are some red flags that come up in the conversation? These are things I'd like for you to address in our last segment, if you don't mind. Can you hang around for one more segment? Yeah, I can. I'll be glad to. All right. Hey, hang on just one minute. This is Peter Rosenberg. We're talking with Hans Scheil. He is the host of the Finishing Well podcast and radio show.

You can go to cardinalguide.com, cardinalguide.com. We'll be right back. This is Hope for the Caregiver.

We'll be right back. Welcome back to Hope for the Caregiver. This is Peter Rosenberg. The joy of the Lord is my strength.

That is Russ Taft and my wife Gracie. That's the underlying foundation of this. We don't need to be afraid. We need to rest in the fact that we have the joy of the Lord. We don't need to be afraid. God, throughout all of scripture, that's the most often commanded scripture is fear not, because He knows we're afraid. We don't have to be.

There's wisdom in a multitude of counselors. So we could even be joyful. I mean, we're happy and giddy. That just means we're joyful knowing that we have a sovereign Savior, but when we seek out strong biblical counsel to say, okay, how do we make these decisions? We're talking about finances.

This is where people get nervous when they talk about this, because things can get out of hand really quick. That's why I invited Hans on the program today. Hans Scheil, author of the book The Cardinal Advisor, The Complete Cardinal Guide, I'm sorry, and Cardinal Advisor, cardinalguide.com is his website and he is the host of the Finishing Well broadcast and podcast.

And I think you would find that he brings not only great financial insight, but he brings great biblical insight. And that's how we can do this joyfully, not fearfully. And when we went to the break, I left you on a little bit of a cliffhanger of, okay, Hans has recommended we go out and not shop the product, but shop the Advisor. And I think that's great wisdom.

How do we know if we're getting in with somebody who may not be the right fit for us? What are some of the warning things or what are some things that we think, maybe we need to go to the next one? So if you wouldn't mind just tackling that a little bit, Hans. I think you're going to have a little trouble just finding people that sell this stuff unless you really ask some questions that leave them there. Because people are in denial even in the financial advising business is that this is such a troubling subject.

This is my theory on it, that there aren't that many people that sell it anymore. And basically there's an audience that doesn't really want to hear about it. So now we've got a customer who's listened to what we've said, and they have some resources, they want to solve this problem for themselves. And now they're out looking for an Advisor. What are some of the things they want to ask? Well, the first thing that sits in my craw a little bit is the financial person who might work in one of the big banks or one of the big stock brokerages who has access to these hybrid products.

And by hybrid, I mean a hybrid life long-term care. And they don't really know much about it. They just have somebody in their firm that knows a little bit about it.

And they're going to say, oh yeah, yeah, we can get you some long-term care. And then they can look at your money because maybe you haven't invested with them and they're going to take the $100,000 that you can put toward this and go out and shop and find a hybrid policy with somebody in their firm. So I think a question you want to ask anybody that you're going to about this is how many of these policies have you sold in the last year? How many new customers have you taken on with this?

And you know, if it's 10 or less, I think you got to find somebody else just simply because this stuff really requires a person to have a working knowledge of it. So that's one thing is just asking them the number of policies. And I think you want to ask them, do you sell traditional long-term care insurance and hybrid long-term care insurance, hybrid life long-term care insurance? I mean, those are two distinct types of insurance. And there's a lot of people out there that only sell one of the two and they don't sell the other.

And I think you want to be able to sit down with somebody who sells both and really can offer both to you depending on which one's right for you. Do you cover this a lot in your podcast? Yeah. These kinds of things? Absolutely. Yeah. Because I want to interrupt you and really encourage people to go out and listen to your podcast and access it because these are very complex things for so many of us.

We feel uncomfortable with it. So I'm glad that you do this. And I love that question. First off, how many do you sell a year? And do you sell traditional long-term care and a hybrid? And if they're not familiar with these products, why do you want to buy it from them? That's basically what you're saying. Well, yeah, they're basically just selling policy if they've got one or two traditional long-term care, and that's all they sell. And some of these people think that the hybrid life long-term care is evil. I mean, they've just come to believe that for whatever reason.

And then vice versa. A lot of the financial people, which I'm one of the financial people, they only sell the hybrid. So they're only going to sell you long-term care if you've got a hunk of money you can throw into it. And they're not well versed on just writing a standard traditional long-term care, which is best for some people. So what we talk about on our show is, based on the book, there's seven worries.

And I'll just rattle them off real quick. Social security, Medicare, long-term care, IRA, 401K, planning and tax planning around that, minimum distributions. Income planning and investment. So when you get retired, your money is more of a source of an income than it is just money sitting in the bank.

And we need to plan that out. Estate planning and planning what happens to your money. And the first benefactor of the estate is the surviving spouse.

So for a lot of people, that's really the extent of the estate plan, is making sure their spouse is going to be okay if they meet an early demise or the other one lives on a lot longer. And then the last one is income taxes. So we take those seven subjects. I'm an expert in all seven of them. And every week, we talk about one of them.

They're called the seven worries. And if you go to cardinalguide.com, you can just find all the seven worries and all our stuff and all our shows and all my YouTube stuff. I mean, believe me, there's a lot of it up there.

We're just talking about it. It's all at cardinalguide.com. Well, and that's a wonderful resource because, you know, the other day I had to fix something. And I live way out in rural Montana now. And if you're not somewhat independent, you're out of luck because help is a long ways away. I live 10 miles from a paved road. So I go to YouTube. Yeah, I live way out in the middle of nowhere.

Montana has been social distancing since 1889. And when I go out to YouTube to find out how to do something because it helps a long way. I mean, even if I got a service repairman to come out here, it'd be forever to get out of here. So you have to learn how to do these things. And there's so many different resources available. And here's a great resource with you of, okay, we don't need to be afraid about this. Let's go get some information. Let's, let's do our due diligence. You've put this out there. This is a real ministry from you. You want people to be able to be confident that they've made good financial decisions and you've provided a step by step.

They're holding people's hands while they do it. And I really appreciate you, you doing this and coming on this program. And I want to, I want to keep having you back on because I think this is going to be an area where so many people struggle and they're afraid and their fear keeps them from making good decisions.

And we don't need to be afraid. We need to be confident and we, we, there are resources available that can help us walk through this. And like you said, and, and please reiterate this for folks who just now joining the program, you have people come to you with very scant resources and yet there is a path for help.

They could always improve. Fair enough. Well, well that's absolutely true. And I just read what I read in the beginning, invite the poor, the crippled, the lame, the blind, and you will be blessed because they cannot repay you. And I think about that every day. And so when somebody calls me, I get calls, I'm licensed in all 50 States in the District of Columbia, and we do our work by phone and by zoom.

And we take care of people anywhere. And the people that have nothing, they're always, I don't think I have enough to talk to you or whatever. And I just say, just come on, I'll let the Lord decide, you know, who, who, who I'm supposed to help and not help. Okay.

And just tell me your problem. And people, I get a lot of joy out of helping the people that are very much in need. I love that. I love that. I'll let the Lord decide.

You just come on. That's, that is, that's what we need. And we need more of this, of what you're doing here in our country. And I'm glad to have you as this resource. If people want to find out more about you again, it's go to, tell, tell us all about your website and how people can get more involved with you.

Yeah, it's the, it's two words smashed together. CardinalGuide.com. CardinalGuide.com. And, you know, you get there and it's just got the Seven Worries tab and it's got all our radio shows, all my YouTube shows.

You can go on YouTube and you can just type Cardinal Advisors and that's ORS, A-D-V-I-S-O-R-S. And you go on YouTube, I've got about 200 videos up there and I'm guessing about 15 of them are about long-term care. So all the things we talked about today, it's all in videos and pretty easy to find. And that's why I don't really talk about myself too much on the radio or the videos because I'm just figuring I'm a pretty easy guy to find.

I mean, you just go into Google and you type Hans Scheil, S-C-H-E-I-L. You just put that in Google and you're just going to get pages of hits on me and they all lead you to the same place. Well, I'm grateful to know you and to learn more about this. I want to have you back on so that people can have a sense of confidence when they approach this. There is no need for us to bow out of having good financial planning. As caregivers, we see firsthand how much more can we take a hit.

And there's no need for us to do this to ourselves. I have to make these decisions, still having to make these decisions. And I've had to adjust and I've had to go sit down and have a humbling conversation over my meager resources with professionals. But you know what?

That's part of it. And we have a Heavenly Father who does not have meager resources. So let's seek the advice and counsel of solid biblical men and women who can help us on that path to financial healthiness.

Healthy caregivers make better caregivers. Hans, thank you so much for being a part of this program today. And I'm going to have you back on, okay? Okay. Thank you and God bless you.

You too. This is Peter Rosenberger, hopeforthecaregiver.com. We'll see you next time. You've heard me talk about Standing with Hope over the years. This is the prosthetic limb ministry that Gracie envisioned after losing both of her legs. Part of that outreach is our Prosthetic Limb Recycling Program. Did you know that prosthetic limbs can be recycled?

No kidding. There is a correctional facility in Arizona that helps us recycle prosthetic limbs. This facility is run by a group out of Nashville called CoreCivic. We met them over 11 years ago and they stepped in to help us with this recycling program of taking prostheses and you disassemble them. You take the knee, the foot, the pylon, the tube clamps, the adapters, the screws, the liners, the prosthetic socks, all these things we can reuse and inmates help us do it. Before CoreCivic came along, I was sitting on the floor at our house or out in the garage when we lived in Nashville and I had tools everywhere, limbs everywhere and feet, boxes of them and so forth.

And I was doing all this myself and I'd make the kids help me and it got to be too much for me. And so I was very grateful that CoreCivic stepped up and said, look, we are always looking for faith-based programs that are interesting and that give inmates a sense of satisfaction and we'd love to be a part of this and that's what they're doing. And you can see more about that at standingwithhope.com slash recycle. So please help us get the word out that we do recycle prosthetic limbs. We do arms as well but the majority of amputations are lower limb and that's where the focus of Standing With Hope is. That's where Gracie's life is with her lower limb prosthesis. And she's used some of her own limbs in this outreach that she's recycled. I mean, she's been an amputee for over 30 years. So you go through a lot of legs and parts and other types of materials and you can reuse prosthetic socks and liners if they're in good shape. All of this helps give the gift that keeps on walking and it goes to this prison in Arizona where it's such an extraordinary ministry.

Think with that. Inmates volunteering for this. They want to do it and they've had amazing times with it and I've had very moving conversations with the inmates that work in this program. And you can see, again, all of that at standingwithhope.com slash recycle. They're putting together a big shipment right now for us to ship over. We do this pretty regularly throughout the year as inventory rises and they need it badly in Ghana. So please go out to standingwithhope.com slash recycle and get the word out and help us do more. If you want to offset some of the shipping, you can always go to the giving page and be a part of what we're doing there.

We're purchasing material in Ghana that they have to use that can't be recycled. We're shipping over stuff that can be and we're doing all of this to lift others up and to point them to Christ. And that's the whole purpose of everything that we do and that is why Gracie and I continue to be standing with hope. Standingwithhope.com.

Whisper: medium.en / 2023-01-24 13:51:55 / 2023-01-24 14:10:38 / 19